Table of Content

What is AOB in Medical Billing?

Assignment of Benefits (AOB) is a legal agreement that allows healthcare providers to be paid directly by insurance companies for services they provide to patients.

Instead of requiring patients to pay upfront and wait for reimbursement, the insurer pays the provider immediately.

This simplifies billing, improves provider cash flow, and reduces the patient’s financial burden during treatment.

Core Purpose: Simplify Payments & Reduce Patient Stress

AOB serves two primary purposes:

- Simplify Payments: Direct insurer-to-provider payments cut down on delays and paperwork.

- Reduce Patient Stress: Patients avoid paying full costs upfront and handling complex reimbursement claims.

By facilitating direct payments, AOB makes the billing process more efficient for everyone involved.

Key Stakeholders: Patients, Providers, Insurers

Three main entities work together in the Assignment of Benefits process:

- Patients: By signing an AOB form, they allow their insurance to pay the provider directly, avoiding upfront payments.

- Healthcare Providers: Get paid directly by insurers, thus minimizing collection efforts and improving cash flow.

- Insurance Companies: Process claims quickly, pay accurately, and reduce fraud risks.

AOB helps create a smoother, more transparent medical billing process, benefiting all parties involved.

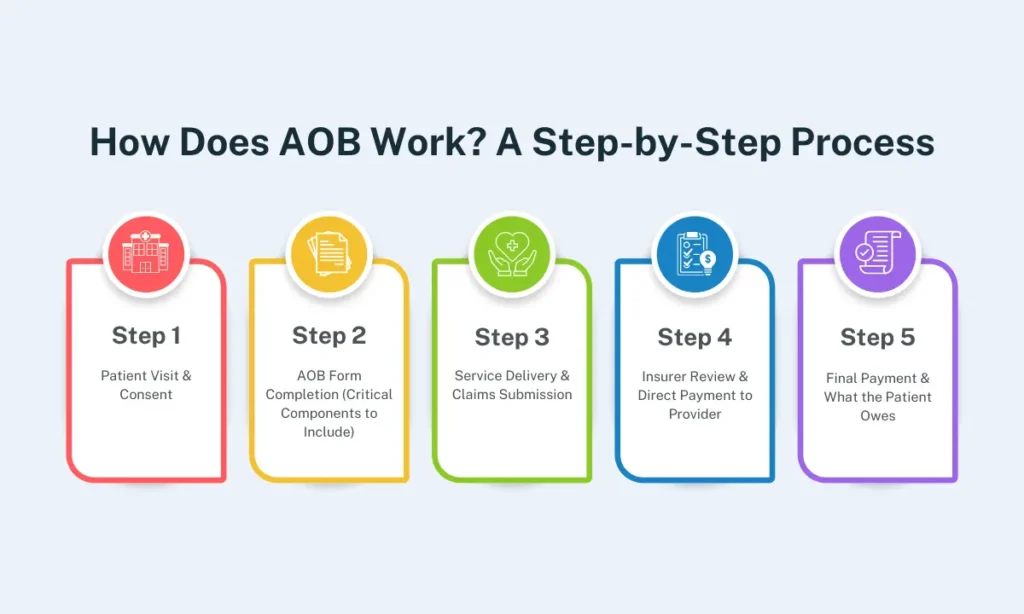

How Does AOB Work? A Step-by-Step Process

The Assignment of Benefits (AOB) process ensures that healthcare providers receive payments directly from insurance companies. This step-by-step breakdown explains AOB’s work, from patient consent to final settlement.

Step 1: Patient Visit & Consent

- The patient visits a healthcare provider for treatment.

- During registration, the provider gives the patient an AOB form to sign.

- The patient reviews and signs the form, letting the provider get paid directly by their insurance.

Step 2: AOB Form Completion (Critical Components to Include)

The AOB form must include:

- Patient Details: Name, birthdate, insurance information.

- Provider Info: Facility name, NPI number, billing address.

- Insurance Permission: A statement allowing direct payment to the provider.

- Non-Cancellation Terms: Some forms prevent patients from revoking the agreement later.

- Patient Signature & Date: Required for legal validity.

Step 3: Service Delivery & Claims Submission

- The provider delivers medical services to the patient.

- They document the services (e.g., medical records, procedure codes).

- The provider sends a claim to the patient’s insurance company for payment.

Step 4: Insurer Review & Direct Payment to Provider

- The insurance company reviews the claim for accuracy and coverage eligibility.

- If approved, the insurer sends payment straight to the provider.

- If denied, the insurer tells the provider and patient about the reasons for rejection.

Learn More: Timely Filing Limit for Claims in Medical Billing

Step 5: Final Payment & What the Patient Owes

- The provider applies the insurance payment to the patient’s bill.

- The patient pays any remaining costs (e.g., copays, deductibles, or non-covered services).

- The billing process ends once all payments are settled.

Understanding this process helps patients, providers, and insurers navigate AOB efficiently.

Assignment of Benefits for Patients, Providers, and Insurers: Roles & Benefits

AOB for Patients

1. Simplified Billing Process

- Patients don’t have to deal with insurers for medical claims processing.

- The provider handles it all, such as paperwork and payment collection.

2. Reduced Upfront Costs

- Patients avoid paying the full medical costs upfront.

- Insurance pays the provider directly, easing money stress.

3. What to Watch Out For

- Unauthorized Charges: Read the AOB form carefully to avoid surprise bills.

- Covered Services Only: Confirm the provider bills only for services your insurance covers.

- Check EOB Statements: Review insurance updates (Explanation of Benefits) for errors.

AOB for Healthcare Providers

1. Faster Reimbursements

- Direct payments from insurers reduce cash flow delays.

- Claims processing is more efficient without patient payment dependencies.

2. Minimized Payment Disputes

- AOB reduces the risk of unpaid bills or delayed patient payments.

- Legal agreements ensure clear financial responsibility between insurers and providers.

3. Compliance Best Practices

- Use AOB forms that follow the law and include all required details.

- Check state rules to ensure insurers accept your AOB agreements.

- Educate patients on AOB terms to prevent misunderstandings.

AOB for Insurance Companies

1. Fraud Prevention Strategies

- Insurers verify AOB forms to detect fraudulent billing practices.

- Conduct audits to stop unauthorized billing.

2. Faster Claims Processing

- Direct payments to providers reduce administrative workload.

- Faster claim settlements improve efficiency and patient satisfaction.

3. Out-of-Network Rules

- Some insurers only accept AOB for in-network providers.

- Patients need to get approval first for out-of-network care.

Assignment of Benefits Legal Considerations & State Regulations

State-Specific AOB Laws (e.g., Florida, Texas)

AOB rules differ by state, affecting how providers and insurers manage direct payments:

- Florida: Has strict AOB rules to reduce fraud. The 2019 AOB Reform Law (HB 7065) limits AOBs to healthcare providers and requires providers to inform insurers in writing.

- Texas: Insurers may restrict AOB acceptance for out-of-network providers, requiring prior approval before claim assignment.

- California & New York: Clear patient consent is needed, and AOB terms must be explained in plain language.

AOB vs. Power of Attorney: Key Differences

Though both involve legal authority transfer, they serve different purposes:

| Feature | AOB | Power of Attorney (POA) |

|---|---|---|

| Purpose | Allows provider to receive direct payment from insurance | Grants someone authority to make decisions on behalf of the patient |

| What It Covers | Only insurance payments | Covers medical, legal, and financial decisions |

| Cancellation | Patients can cancel unless the form says they can’t | Usually canceled anytime unless specified |

| Use Case | Common in medical billing | If a patient can’t make decisions themselves |

Common Legal Issues & How to Fix Them

Assignment of Benefits agreements can face legal challenges, especially when insurers deny claims or limit AOB acceptance.

Common Disputes:

- Insurance denials: Insurers refuse payment due to policy rules.

- Surprise bills: Patients argue they didn’t approve certain charges.

- Fake claims: Providers submit false bills to overcharge insurers.

How to Resolve Disputes:

- Use state-run programs (e.g., Texas’ dispute resolution system).

- Take legal action if insurers or providers break the agreement.

- Double-check policies to avoid denials from rule-breaking.

What Must Be in an Assignment of Benefits Agreement

A legally sound AOB agreement should include the following:

- Permission to Pay: The patient agrees insurers pay the provider directly.

- Services Covered: Lists what treatments the AOB applies to.

- Cancellation Rules: Explains how patients can cancel the AOB.

- Anti-Fraud Terms: Prevents providers from billing for fake services.

- Patient Consent: Clear proof the patient understood and agreed to the terms.

Assignment of Benefits Fraud Prevention: Protecting Everyone

Ordinary AOB Fraud Schemes (e.g., Phantom Services)

Fraudulent AOB practices can lead to higher healthcare costs, denied claims, and legal trouble. Some typical schemes include:

- Phantom Services: Billing for treatments that were never provided.

- Upcoding: Charging for a more expensive procedure than what was performed.

- Unbundling: Separating services that should be billed together to increase costs.

- Forgery & Unauthorized AOB Use: Patients unknowingly sign AOB forms, allowing fraudulent claims.

Red Flags for Patients & Insurers

Patients and insurers should stay alert to fraud indicators to prevent financial losses.

For Patients:

- Receiving bills for unknown or duplicate services.

- Pressure from a provider to sign an AOB form immediately.

- A provider guarantees “free treatment” or “no out-of-pocket costs.”

For Insurers:

- A provider suddenly submits way more claims than usual.

- Missing or mismatched paperwork for claims.

- Patients reporting unfamiliar services on Explanation of Benefits (EOB) statements.

How Providers Can Verify Legitimate Claims

To prevent fraudulent claims, providers must ensure transparent and accurate billing:

- Verify Patient Identity & Insurance Coverage: Confirm insurance eligibility before services.

- Maintain Detailed Medical Records: Proper documentation supports claim legitimacy.

- Use Standard Billing Codes: Follow Current Procedural Terminology (CPT) codes to reduce errors.

- Audit Regularly: Review billing patterns to catch red flags early.

Technology’s Role: AI & Blockchain in Fraud Detection

Advanced technologies enhance fraud detection by identifying anomalies in claim data.

AI & Machine Learning:

- Detects billing inconsistencies and patterns of fraudulent claims.

- Automates claim verification, reducing human errors.

Blockchain for Secure Transactions:

- Creates a tamper-proof digital ledger of medical transactions.

- Makes billing transparent for patients, providers, and insurers.

By implementing fraud detection strategies, all parties can minimize financial risk and maintain trust in the AOB system.

Stop Fraud, Secure Payments

Guaranteed AOB Compliance & Audit-Proof Billing – Only 3.99%!

[Talk to Our Experts] to Protect Your Practice

Challenges & Solutions in Assignment of Benefits Management

Patient Confusion & Miscommunication

Challenge: Many patients misunderstand AOB agreements, leading to surprise bills or denied claims.

Solution:

- Use precise, plain-language AOB forms.

- Provide verbal explanations during intake.

- Offer FAQs or educational brochures to clarify patient rights and responsibilities.

Navigating Out-of-Network Provider Scenarios

Challenge: Some insurers reject AOB claims for out-of-network providers, leading to unpaid bills or patient liability.

Solution:

- Verify insurance policies upfront to check AOB eligibility.

- Inform patients about potential out-of-pocket costs.

- Negotiate direct-pay agreements with insurers where possible.

Claim Denials & Appeals Process

Challenge: Insurers may deny claims due to missing information, coding errors, or non-compliance with AOB terms.

Solution:

- Track claims in real time to catch problems fast.

- Train staff in accurate coding and documentation.

- Create a straightforward step-by-step appeal process for denied claims.

Best Practices for Clear Documentation

Challenge: Incomplete or incorrect documentation leads to claim rejections and delayed payments.

Solution:

- Maintain detailed patient records, including treatment notes and signed AOB forms.

- Use electronic health records (EHRs) for easy data management.

- Use standard billing codes and checklists to avoid mistakes.

By proactively addressing these challenges, healthcare providers can streamline AOB management, reduce claim rejections, and enhance patient satisfaction.

Tired of Claim Denials Draining Your Revenue?

Get 97%+ Collections with Expert Medical Billing Services – Starting at 3.99%!

[Schedule a Free Consultation] to Slash Denials & Boost Cash Flow

The Future of Assignment of Benefits (AOB): Technology & Trends

EHR Integration for Seamless Claims

Electronic Health Records (EHRs) simplify AOB by automating data entry, claim submission, and insurer communications. When AOB forms are built into EHR systems, providers reduce errors and get paid faster.

Automated Compliance Checks

AI-driven tools help providers verify state regulations, insurer policies, and documentation accuracy before claim submission. This reduces denials, legal risks, and administrative overhead.

Patient Education Tools

Educating patients about AOB enhances transparency and reduces confusion over billing responsibilities. Key tools include:

- Interactive Portals for real-time claim tracking and FAQs.

- Mobile Apps that notify patients of claim statuses, coverage details, and outstanding balances.

- Educational Videos & Webinars explaining AOB terms, patient rights, and insurance policies.

The Role of Mobile Apps in AOB Tracking

Mobile solutions allow patients to digitally sign AOB forms, receive real-time claim updates, and communicate with insurers. Providers can also send notifications for required documentation, reducing delays.

By leveraging technology-driven solutions, AOB processes become more efficient, transparent, and user-friendly.

Future-Proof Your Billing Process

AI-Powered Medical Billing + AOB Compliance = Faster Payments & Happier Patients.

[Claim Your Free Audit] to Unlock Hidden Revenue

Frequently Asked Questions (FAQs)

Can I Revoke an AOB Agreement?

Revoking an AOB agreement depends on state laws and insurer policies. Some states allow revocation under specific conditions, while others require the provider’s and insurer’s written consent. Always check the AOB terms before signing.

What Happens if My Claim is Denied After Assignment of Benefits?

The provider may appeal the decision with supporting documentation if a claim is denied. Patients might still be responsible for uncovered services, including copayments and deductibles. Providers should clarify patient obligations upfront.

Does Assignment of Benefits Affect My Insurance Coverage?

No, AOB does not change coverage limits or benefits. It only determines who receives payments, the provider, instead of the patient. However, insurers may impose network restrictions or additional verification steps for AOB claims.

How Do State Laws Impact the Assignment of Benefits Validity?

AOB laws vary by state. Some states, like Florida and Texas, have strict regulations to prevent fraud and abuse. Providers and patients should review state-specific AOB requirements to ensure compliance.

How Can Insurers Detect Fraudulent AOB Claims?

Insurers use AI-driven fraud detection, data analytics, and claim pattern analysis to flag suspicious activities like phantom billing or inflated charges. Routine audits and patient verification steps further help mitigate fraud risks.

What Compliance Risks Do Providers Face?

Providers must ensure AOB agreements meet legal standards, including mandatory disclosures, patient consent, and fraud prevention measures. Non-compliance can result in claim denials, penalties, or legal action from insurers or regulators.

Optimize Your PC Ratio Today

Higher Collections, Lower Costs – All for 3.99%.

[Get Started Now] to Transform Your Medical Billing

Related Posts