Medical billing clearinghouses are an essential part of the healthcare revenue cycle. They act as digital go-betweens that help convert, check, and send electronic claims from healthcare providers to insurance payers.

Clearinghouses improve communication between healthcare providers and insurance payers. They reduce denials, boost accuracy, and ensure faster payments.

This article provides a step-by-step breakdown of how clearinghouses work, from claim creation to payer adjudication and payment posting. It also covers the leading technologies used, common issues, and how clearinghouses help medical practices improve their revenue cycle.

Why Are Healthcare Clearinghouses Important?

A healthcare clearinghouse is a third-party service that handles electronic claims. It takes the data from healthcare providers and converts it into a standard format (like EDI 837) that insurance companies can read.

Clearinghouses are essential because they:

- Reduce human errors in claims

- Increase clean claim rates

- Ensures compliance with payer-specific rules

- Speed up the claim lifecycle

Learn More: Top 10 Clearinghouses in Medical Billing 2025: Best Picks for Fast Claims & Fewer Denials

Table of Contents

Step-by-Step Breakdown of the Claim Submission Workflow

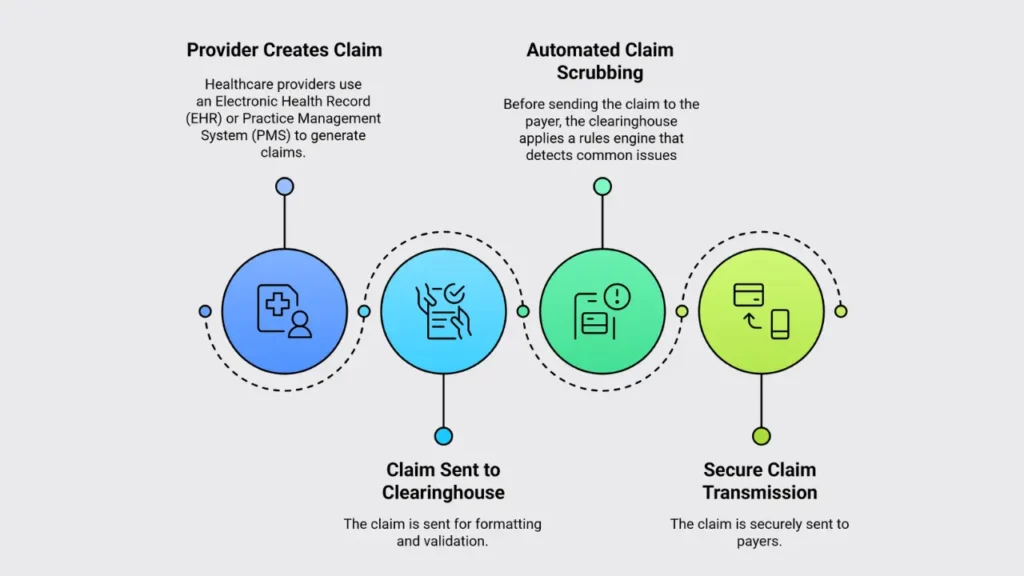

1. Provider Creates the Claim

Healthcare providers use an Electronic Health Record (EHR) or Practice Management System (PMS) to generate claims. Each claim includes:

- Patient demographics

- ICD-10 diagnosis codes

- CPT or HCPCS procedure codes

- Insurance policy details

- Provider’s National Provider Identifier (NPI)

This data represents the services delivered and forms the foundation of the claim.

2. Claim Sent to Clearinghouse for Formatting

Once submitted, the clearinghouse:

- Converts the claim into EDI 837 format (Electronic Data Interchange)

- Validates the structure based on X12 standards

- Ensures fields are populated correctly and in the correct format

This standardization step is essential for payer systems to process medical claims processing efficiently.

3. Automated Claim Scrubbing & Pre-Submission Validation

Before sending the claim to the payer, the clearinghouse applies a rules engine that detects common issues, including:

- Missing or incorrect patient/insurance details

- Invalid or mismatched ICD-10 and CPT codes

- Non-compliance with payer-specific rules (e.g., LCD/NCD policies)

- NPI mismatches or expired identifiers

Claims that fail these checks are flagged, and providers receive real-time notifications. Staff can correct and resubmit before transmission.

4. Secure Claim Transmission to Payers

Validated claims are encrypted using TLS/SSL protocols and transmitted via:

- Direct connection to the insurance payer

- Or routed through a larger clearinghouse network

This ensures secure, HIPAA compliant communication.

Learn More: How Do Healthcare Clearinghouses Maintain HIPAA Compliance?

What Happens After the Claim Reaches the Payer?

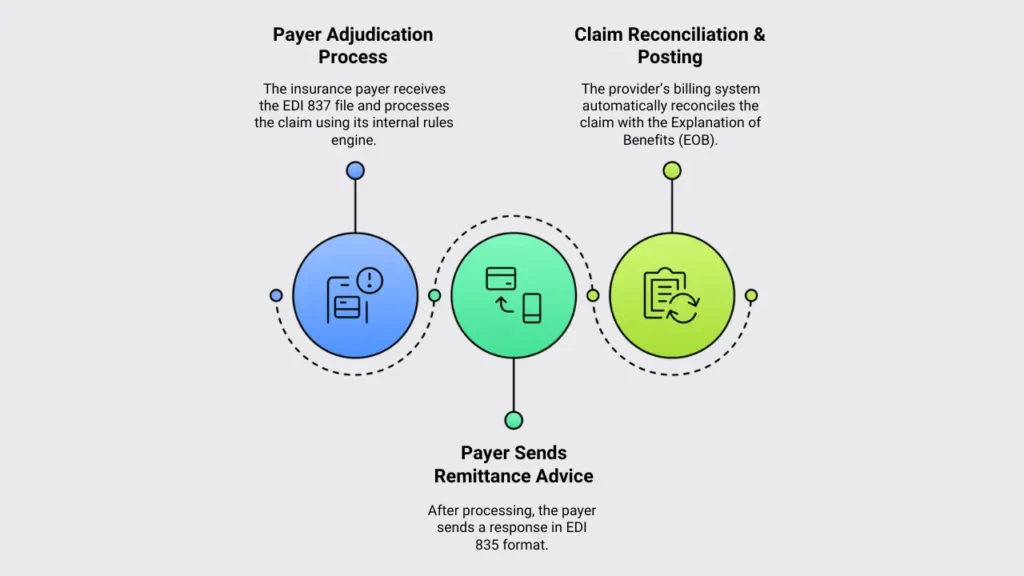

1. Payer Adjudication Process

The insurance payer receives the EDI 837 file and processes the claim using its internal rules engine, which evaluates:

- Medical necessity of services

- Coverage eligibility under the patient’s plan

- Policy-specific requirements (e.g., prior authorization, supporting documentation)

The outcome is approval (full/partial payment) or denial/rejection

2. Payer Sends Remittance Advice (EDI 835)

After processing, the payer sends a response in EDI 835 format, including:

- Payment details (amount paid, patient responsibility)

- Adjustment codes (e.g., contractual write-offs)

- Denial reason codes (e.g., CO-22 [duplicate claim], CO-16 [missing/incomplete data])

3. Claim Reconciliation & Posting

The provider’s billing system automatically reconciles the claim with the Explanation of Benefits (EOB). This process:

- Updates financial records (accounts receivable)

- Posts payments and patient balances

- Triggers follow-up workflows for unpaid/denied claims

Post-Submission Optimization: Resubmissions & Analytics

Clearinghouses go beyond initial claim submission. They drive denial prevention and revenue cycle efficiency through two key functions:

1. Denial Management & Claim Resubmission

When claims are rejected, clearinghouses accelerate resolution by providing:

- Detailed denial reasons (e.g., CO-16 “Claim/service lacks information,” CO-4 “Procedure code inconsistent with modifier”)

- Root-cause tagging: Categorizes errors (e.g., eligibility, coding, or authorization issues)

- Automated workflows: Some systems auto-correct and resubmit claims; others flag errors for staff review

Impact: Reduces rework time and increases clean claim rates by 15–30%.

2. Real-Time Analytics & Performance Tracking

Advanced platforms offer customizable dashboards with:

- Live claim status (e.g., 23% pending, 12% denied this month)

- Payer performance metrics: Compare denial rates (e.g., Payer X denies 18% vs. the industry average of 12%)

- Trend alerts: Spike in CO-22 denials? The system flags potential duplicate claim issues

- ROI reports: Measures revenue recovery from resubmissions

📊 Real-World Example:

A cardiology group reduced denials from 22% to 7% in 4 months by:

- Using AI-powered claim scrubbing to detect missing authorizations pre-submission.

- Training staff on top 5 denial reasons (identified via clearinghouse analytics).

- Automating ERA posting to reconcile payments 50% faster.

Learn More: Clearinghouse vs. Direct Billing: Which Claim Submission Method Fits Best?

Core Technologies Powering Medical Billing Clearinghouses

| Technology | Purpose |

|---|---|

| EDI 837/835 | Standardized HIPAA-compliant formats for: – Claims submission (837) – Payment remittance (835) |

| Rules Engine | Validates claims against: – Payer-specific billing rules – CMS guidelines (e.g., NCCI edits) |

| AI Scrubbing | Identifies potential errors in: – Coding (CPT/ICD-10 mismatches) – Patient eligibility |

| API/HL7 | Enables data exchange between: – EHR systems – Practice management software – Payers |

Together, these technologies form the digital backbone of the modern claim lifecycle.

Common Claim Rejection Triggers and How Clearinghouses Help

Frequent Rejection Causes:

- Invalid CPT or ICD-10 codes

- Expired insurance policies

- NPI mismatches

- Incorrect code combinations

Clearinghouse Solutions:

- Pre-submission validation against real-time payer rules

- Dynamic error detection based on payer history

- Alerts for expired coverage or authorization requirements

- Automated scrub-and-resubmit workflows

✅ This process typically raises the clean claim rate from 80% to 95% or higher.

🚀 Maximize Your Revenue with Error-Free Claim Processing

Let Our RCM Medical Billing Company– Your Trusted Medical Billing Clearinghouse Partner

✔ 97% Clean Claim Rate – Our medical billing services catch errors before submission

✔ 30-Day Faster Payments – Direct clearinghouse integration with all major payers

✔ End-to-End HIPAA Compliance – AES-256 encryption & audit-ready reporting

Let Our Medical Billing Experts Optimize Your Revenue Cycle

Frequently Asked Questions (FAQ’s)

What is a clean claim?

A clean claim is error-free, meets all payer requirements, and gets accepted on the first submission. This speeds up reimbursement and reduces follow-ups.

How quickly are claims sent to payers?

Clearinghouses send claims within minutes or hours, often in real-time. Batch processing may cause slight delays, but it’s much faster than paper submissions.

What’s the difference between 837 and 835?

The 837 is the claim submission file (sent to payers), while the 835 is the remittance advice (the payer’s response with payment details).

How do clearinghouses reduce denials?

They use automated scrubbers to catch errors like incorrect codes or missing data before submission, ensuring claims meet payer rules.

Are Medicaid and Medicare claims supported?

Yes, but they require strict compliance with Medicare’s LCD/NCD rules and state-specific Medicaid policies to avoid rejections.

Can a clearinghouse work with any EHR?

Most integrate via HL7/FHIR APIs, but older or niche EHRs may need custom setups for seamless connectivity.

What is a payer rules engine?

It automatically checks claims against payer-specific policies (like bundling or prior auth rules) to prevent denials before submission.

How long does claim adjudication take?

Electronic claims take 7–14 days, while manual/paper claims can take 30+ days. Clearinghouses help speed up the process.

Healthcare EDI & Billing Glossary: Key Terms (837, 835, NPI, CPT, FHIR & More)

1. Adjudication: The payer’s process for reviewing claims to decide whether they will be approved, denied, or adjusted is based on insurance coverage, provider contracts, and medical necessity.

2. Claim Scrubbing: An automated check before submission that finds errors like missing data, wrong codes, or compliance issues. This helps lower the chance of denials.

3. CPT/HCPCS Codes

- CPT Codes: Standard codes used for medical procedures and services.

- HCPCS Codes: Codes for medical supplies, equipment, and drugs used along with CPT.

4. EDI 837: A standard electronic format for sending claims.

- 837P is used for professional claims.

- 837I is used for institutional claims.

5. EDI 835 is a standard file format payers use to send back payment details, including any claim adjustments or denial reasons.

6. ERA (Electronic Remittance Advice): A digital summary (sent in EDI 835 format) that explains what was paid, denied, or adjusted in a claim.

7. FHIR/HL7 APIs

- HL7: An older messaging standard for sharing healthcare data.

- FHIR: A newer, API-based standard that supports modern data exchange and system integration.

8. ICD-10 Codes are international codes used to describe diseases and medical conditions on claims.

9. LCD/NCD Policies

- NCD (National Coverage Determinations): Medicare’s official coverage rules that apply nationwide.

- LCD (Local Coverage Determinations): Region-specific rules from local Medicare contractors.

10. NPI (National Provider Identifier): A unique 10-digit number is used to identify healthcare providers in billing and insurance systems.