Hiring the wrong billing partner can cost your practice thousands in lost revenue, delayed reimbursements, and compliance risks. In 2025, the right medical billing company must do more than submit claims. It should handle coding accuracy, payer rules, credentialing, and real-time reporting. With dozens of options on the market, choosing a billing partner requires a clear evaluation of their systems, certifications, and specialty experience. This guide outlines exactly what to look for to protect your revenue and improve collections.

Table of Contents

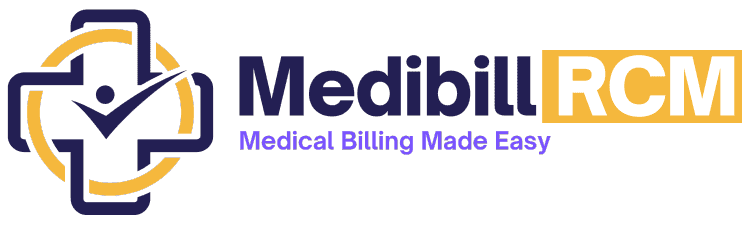

What Should You Evaluate Before Hiring a Medical Billing Service?

When choosing a medical billing partner, you need to assess specific operational, financial, and compliance factors. These directly affect your revenue cycle performance and claim success rate.

1. Confirm Specialty Support

A billing company must understand the rules, coding, and prior authorization needs of your specialty.

- Cardiology requires correct modifier use for bundled services

- Pediatrics involves frequent vaccine administration codes and age-based billing rules

- Urgent care often includes same-day billing and high-visit volumes

- Behavioral health requires timed service codes and diagnosis linking

- Oncology must handle prior authorizations and drug unit reporting accurately

Ask for examples of claims they’ve handled in your specialty. For multi-provider practices, ensure your billing partner clarifies roles between rendering providers vs. billing providers to avoid claim rejections.

2. Check Payer Coverage and Claim Types

Billing partners should handle medical claims processing across both public and private payer landscapes.

- Government Payers: Medicare, Medicaid (state-specific rules)

- Commercial Payers: Aetna, Blue Cross Blue Shield, Cigna, UnitedHealthcare

- Worker’s Comp & Auto Claims: Often need separate workflows

- Out-of-network Billing: Must include UCR strategy and appeals tracking

Ensure the billing firm tracks payer-specific requirements for pre-authorization, attachments, and modifier rules.

3. Compare Billing Models to Your Revenue Goals

Two common billing models exist. Choose based on volume, complexity, and collection targets.

| Billing Model | Description | Best for |

|---|---|---|

| Flat Monthly Fee | Fixed cost regardless of revenue | High-volume, consistent revenue |

| % of Collections | Fee based on actual collections (e.g. 5%-8%) | Growing practices with variability |

Ask for the average recovery rate under each model.

4. Verify Coding Accuracy and Compliance

The billing company must comply with CMS coding standards and industry guidelines.

- Use certified coders (e.g., CPC, CCS-P, CPB)

- Maintain updated CPT, ICD-10-CM, and HCPCS Level II references

- Follow National Correct Coding Initiative (NCCI) edits

- Support specialty-specific modifier combinations and LCD/NCD guidelines

Know the key differences between medical billing and coding and how they affect revenue—read our guide: Medical Billing vs. Medical Coding.

Request internal audit reports or sample coding reviews.

5. Ensure Claims Management Support

Revenue protection depends on how they handle rejected and denied claims.

- Edits: Built-in claim scrubbing to catch pre-submission issues

- Rejections: Resubmission within 24–48 hours

- Denials: Root-cause tracking with appeal submission logs

- Appeals: Specialty-specific appeal templates and timely filing monitoring

Confirm whether the appeal filing is included or billed as extra.

Learn More: Timely Filing Limit for Claims in Medical Billing

How Do In-House and Outsourced Billing Models Compare?

Choosing between in-house billing and an outsourced Revenue Cycle Management (RCM) partner affects your practice’s cost structure, efficiency, and compliance. Here’s a side-by-side comparison based on key operational areas:

| Feature | In-House Billing | Outsourced RCM Partner |

|---|

| Fixed Cost Burden | High — salaries, training, software, HR | Low — fee tied to collections, no overhead costs |

| Denial Management | Limited to internal capacity and knowledge | Dedicated team with denial tracking, root-cause analytics |

| Technology Stack | Often outdated, siloed systems | Unified, cloud-based platform with real-time reporting |

| A/R Follow-up & Appeals | Manual processes, reactive handling | Automated workflows, audit trails, and follow-up SLAs |

| HIPAA Security | Internal policies and IT-dependent safeguards | Third-party encrypted systems, annual HIPAA audits |

Key Takeaways:

- Cost Efficiency: Outsourcing removes fixed staffing burdens and shifts costs to a variable model.

- Denial Recovery: RCM firms use templates, analytics, and full-time appeal specialists.

- Tech Edge: Centralized RCM platforms reduce claim errors and improve transparency.

- Security & Compliance: Leading RCM vendors undergo third-party audits (SOC 2, HITRUST) and maintain BAA coverage.

Outsourced billing reduces administrative friction and improves collection outcomes, especially for growing or multi-specialty practices. Explore the Benefits of Outsourcing Medical Billing Services.

Which Services Should Be Included in a Full-Service Billing Contract?

A full-service billing partner should manage every step of your revenue cycle with accuracy, transparency, and compliance. Below are the non-negotiable services that define a complete medical billing contract:

1. Medical Coding by Certified Experts

- Apply CPT, ICD-10-CM, and HCPCS codes based on encounter documentation

- Follow specialty-specific coding guidelines and payer edits

- Use certified coders (CPC, CPB, CCS-P) with ongoing training

- Implement NCCI edits and LCD/NCD rules to reduce rejections

Accurate coding ensures faster reimbursements and reduces compliance risks.

2. Credentialing and Payer Enrollment

- Submit provider applications for commercial and government payers

- Track re-credentialing timelines to prevent payment holds

- Manage CAQH profiles, NPPES, and state-specific requirements

- Handle group NPI, tax ID linkage, and EFT enrollments

Credentialing errors can delay payments for 60+ days — this step is critical.

3. Electronic Claims Submission Across All Payers

- Submit claims to Medicare, Medicaid, and commercial payers

- Use clearinghouse integrations with real-time rejection feedback

- Support attachments (e.g., medical records, authorization letters)

- Automate batch submission with daily audit checks

Clean claim submission within 24 hours increases first-pass approval rates.

4. Payment Posting and Reconciliation

- Post ERA (Electronic Remittance Advice) data within 24–48 hours

- Match payments against CPT-level expected amounts

- Flag underpayments and initiate payer follow-ups

- Reconcile against bank deposits and patient payments

Accurate posting gives you a true picture of your revenue performance.

5. Denials, Appeals, and AR Recovery

- Track denials by type, payer, and root cause

- File appeals with specialty-specific language and supporting documentation

- Rework rejected claims quickly to meet timely filing limits

- Focus on accounts over 30, 60, and 90 days with automated AR workflows

Look for firms that maintain (less than) <5% denial rates and (Greater than or equal to) ≥96% net collection rates.

6. Compliance Audits and Regulatory Readiness

- Internal audits aligned with CMS, HIPAA, and OIG standards

- Monitor changes to fee schedules, LCDs, and billing guidelines

- Conduct regular policy reviews and coder retraining

- Maintain audit readiness with complete documentation and logs

Your billing partner must be CMS- and HIPAA-ready at all times.

7. Patient Billing and Support

- Send statements by mail or portal with clear balances and payment options

- Offer patient support lines for billing questions

- Provide payment plans and online payment integration

- Manage early-out collections and aging patient balances

Billing transparency improves patient satisfaction and reduces unpaid balances.

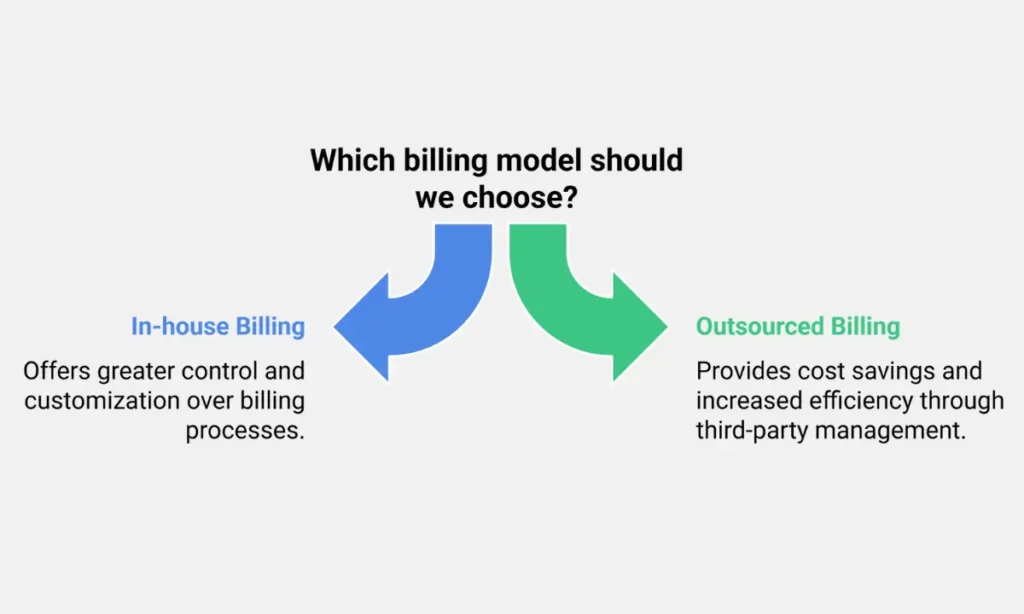

How Transparent Is Their Billing Process?

Billing transparency determines how well you can monitor performance, spot issues, and make informed financial decisions. A reliable billing partner should offer full visibility into every stage of the revenue cycle.

1. 24/7 Access to Billing Dashboards

1. View real-time claim status, aging reports, and revenue trends

2. Monitor key billing KPIs:

- First-pass resolution rate

- Days in A/R

- Denial rate

- Net collection rate

3. Filter by provider, payer, or date range

Dashboards reduce blind spots and help you audit performance without waiting for monthly reports.

2. Real-Time EHR Integration

- Confirm integration with platforms like eClinicalWorks, Athenahealth, DrChrono, AdvancedMD, or Kareo

- Ensure bi-directional data sync: charges, demographics, insurance, notes

- Look for HL7 or API-based integration for speed and reliability

Without proper integration, claim errors and delays increase.

Related Post: EHR in Medical Billing (2025): Benefits, Problems & Top Software Compared

3. Sample Financial Reports

Request monthly reports showing:

- Gross charges vs. payments

- Write-offs and adjustments

- A/R aging buckets (0–30, 31–60, 61–90, 90+ days)

- Denial trends and resolution actions

Ask for drill-down capability into CPT-level or payer-level metrics.

Good reporting shows both financial health and operational efficiency.

4. Clear Service Level Agreements (SLAs)

A trustworthy billing company should define and meet minimum performance guarantees:

| SLA Metric | Target Benchmark |

|---|---|

| Claim Submission TAT | Within 24–48 hours |

| Denial Rate | ≤ 5% |

| First-Pass Resolution Rate | ≥ 95% |

| Response Time (Support) | < 24 business hours |

SLAs turn performance into contractual commitments, not vague promises.

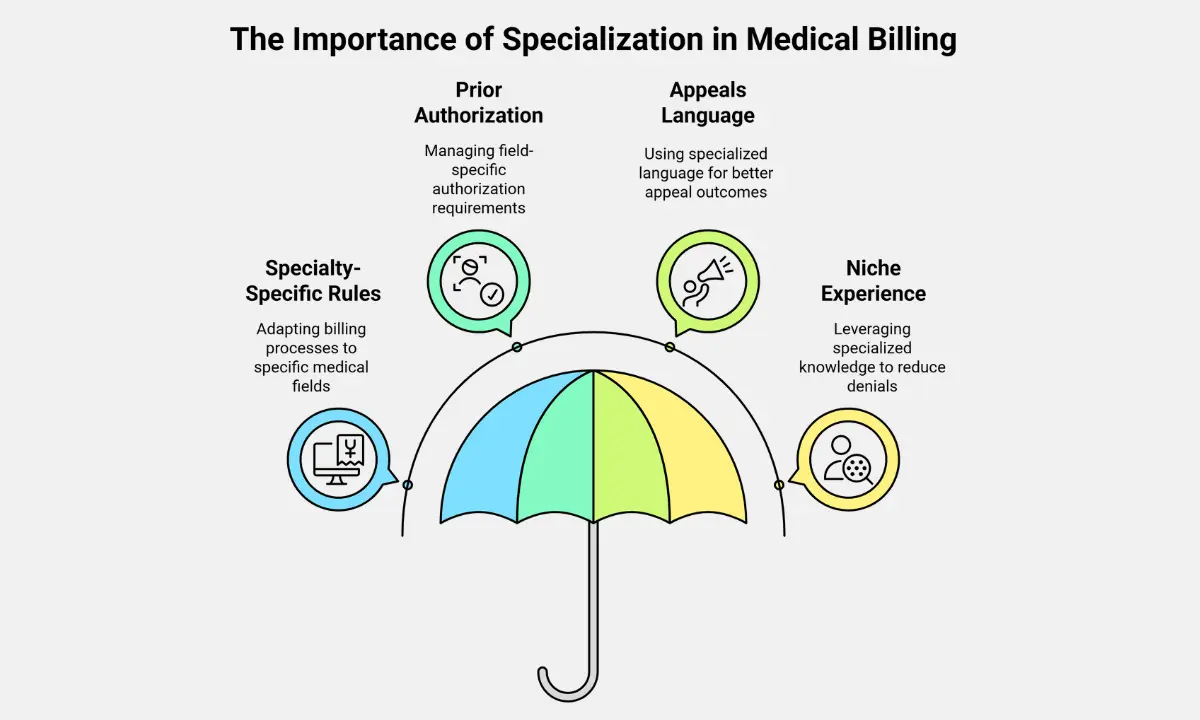

Why Does Industry Specialization Matter in Medical Billing?

Medical billing isn’t one-size-fits-all. Each specialty has unique coding rules, documentation standards, and payer expectations. A billing company with industry-specific expertise directly improves your claim acceptance rate and cash flow speed.

1. Specialty-Specific Modifier and Bundling Rules

1. Different specialties require nuanced use of CPT modifiers:

- Cardiology: Modifier 59 for bundled diagnostics

- Orthopedics: Global period modifiers (24, 25, 57)

- Anesthesia: Base units, time-based codes, physical status modifiers

2. Bundling rules vary by payer and procedure combinations

Incorrect modifier use causes denials or underpayments.

2. Prior Authorization and Diagnosis Pairing Vary by Field

- Oncology: PA needed for chemotherapy regimens and specialty drugs

- Mental Health: Diagnosis code must align with time-based CPTs (e.g., 90837)

- Dermatology: Lesion excisions need size, location, and pathology linkage

- OB/GYN: Global billing windows require accurate timing of services

Billing firms without specialty context often miss these nuances.

3. Specialty-Tailored Appeals Improve Results

- Strong appeal letters require clinical language aligned with specialty

- Specialty billing teams use proven templates with peer-reviewed support

- Example: Mental health appeals cite DSM-5 criteria and parity laws

- Example: Neurology appeals highlight the medical necessity for EEG or EMG testing

Tailored appeals increase overturn success rates and reduce payment delays.

4. Niche Experience Reduces Payer Pushback

1. Specialty-experienced billing teams know:

- Which payers flag which procedures

- Which documentation triggers audits

- How to avoid frequent rejections through correct initial coding

2. They adapt quickly to changes in CPT guidelines and payer policy updates.

Specialized billing reduces your denial rate, often below 4%.

What Billing KPIs Indicate High Performance?

Tracking the right billing KPIs helps you measure your RCM partner’s effectiveness and identify revenue leaks early. A high-performing billing company consistently meets or exceeds industry benchmarks.

📊 Key Billing Performance Metrics

| KPI | Definition | Industry Benchmark |

|---|---|---|

| First-Pass Claim Rate | % of claims paid without rework or resubmission | ≥ 95% |

| Days in A/R | Average time from claim submission to full payment | ≤ 30 days |

| Net Collection Rate | % of collectible revenue actually collected | ≥ 96% |

| Denial Rate | % of claims denied by payers | ≤ 5% |

| Clean Claim Submission Time | Time from encounter to claim submission | ≤ 24 hours |

Why These Metrics Matter

- High first-pass rates reduce admin overhead and speed up collections

- Low A/R days improve cash flow predictability

- Strong net collections reflect true reimbursement efficiency

- Low denial rates indicate accurate coding and payer rule compliance

- Fast submission times reduce missed deadlines and avoid timely filing denials

Always ask your billing partner to report these KPIs monthly, segmented by provider and payer.

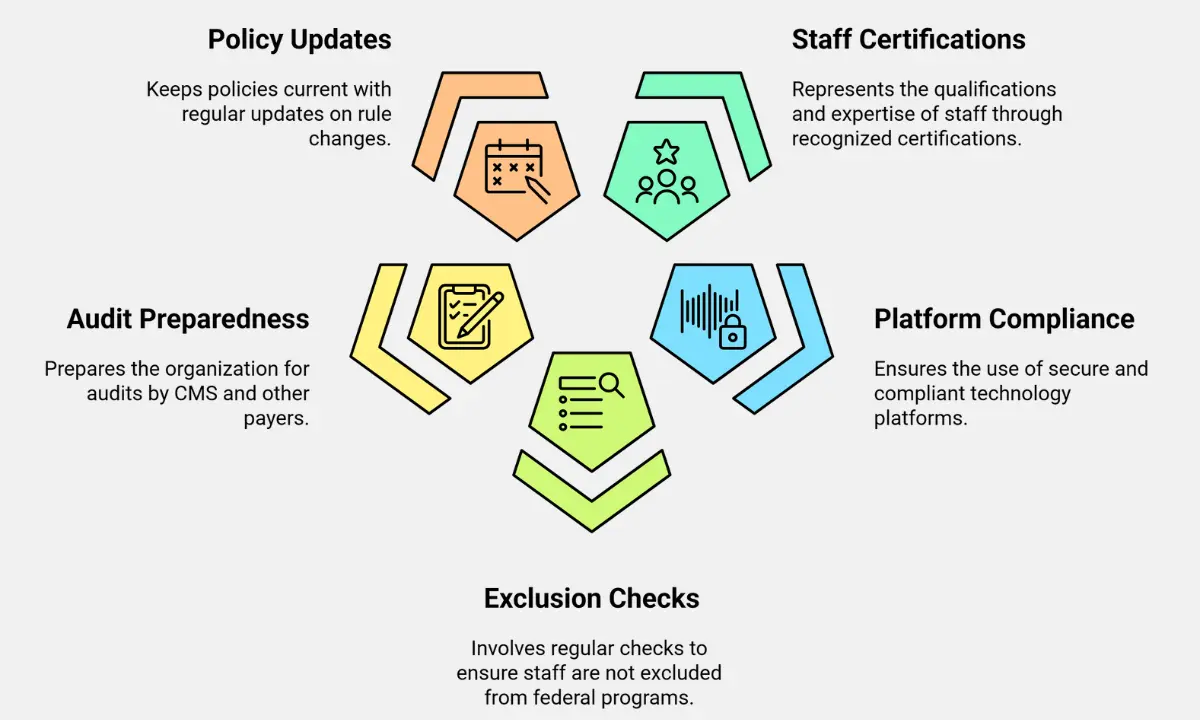

What Certifications and Compliance Standards Should You Expect?

Medical billing involves handling sensitive data and adhering to strict payer and regulatory requirements. Your billing partner must demonstrate compliance through certifications, structured audits, and standardized practices.

1. Certified Billing and Coding Staff

1. Ensure coders and billers hold certifications from:

- AAPC: CPC (Certified Professional Coder), CPB (Certified Professional Biller)

- AHIMA: CCS-P (Certified Coding Specialist–Physician-based)

2. Staff should complete annual CEUs to stay updated on coding changes

3. Ask for the certification mix across their billing, coding, and compliance teams

Certified professionals reduce the risk of improper coding and denied claims.

2. HIPAA-Compliant Infrastructure

1. Billing platforms should include:

- Data encryption (TLS 1.2 or higher)

- Role-based access controls

- Secure hosting and BAA agreements

2. SOC 2 and HITRUST certifications are added security benchmarks

3. Ensure the vendor has formal HIPAA training for all staff

HIPAA violations can lead to fines of up to $50,000 per incident.

3. OIG Exclusion Monitoring

- All employees should be screened monthly against the OIG Exclusion List

- Check for ongoing monitoring of state Medicaid exclusions and SAM.gov

- Documented policies must be in place for non-compliance or flagged staff

OIG violations can disqualify your claims from Medicare/Medicaid reimbursement.

4. CMS and Payer Audit Readiness

- Ask if the vendor maintains audit packets with coding notes, claim logs, and payer communication

- They should track overpayment risks and support RAC or MAC audit responses

- Ensure claims comply with NCDs (National Coverage Determinations) and LCDs

Audit preparedness reduces disruptions and protects your revenue during reviews.

5. Real-Time Compliance Policy Updates

The billing partner should:

- Monitor quarterly CMS updates

- Track NCCI edit changes

- Communicate policy updates that affect coding or modifier use

- Update internal SOPs regularly

Staying current on payer policy shifts reduces denial risk and keeps coding accurate.

Related Post: Medical Billing Compliance Checklist For 2025

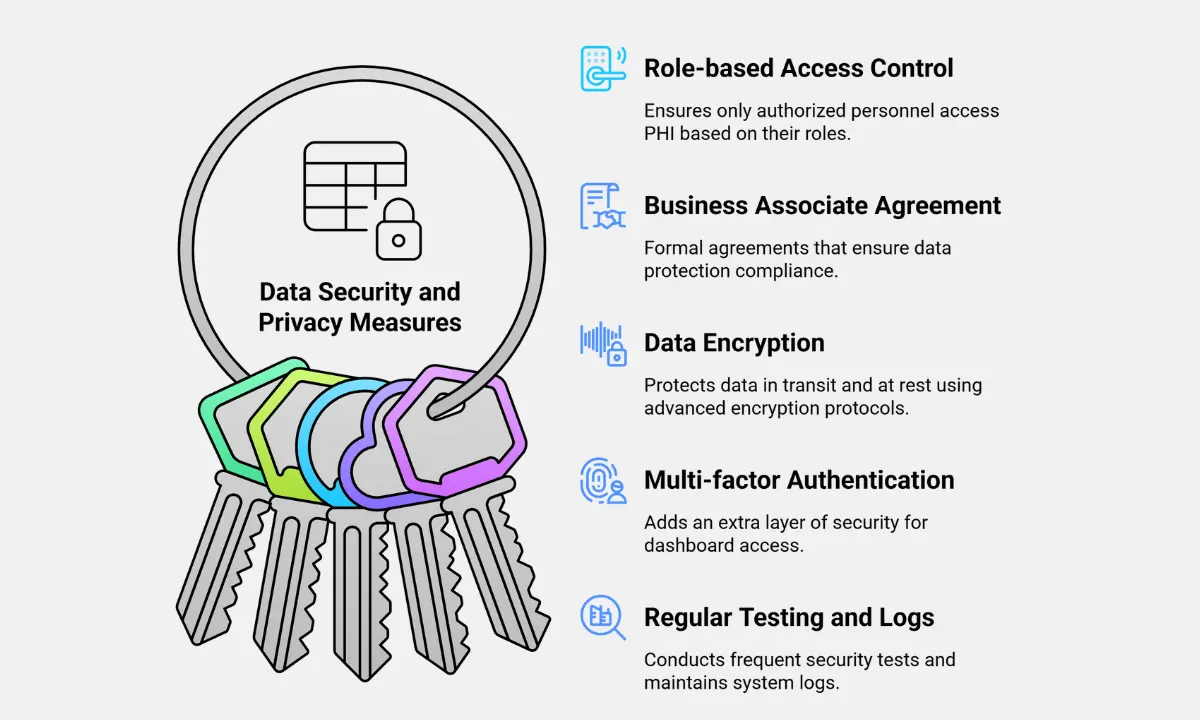

What Data Security and Privacy Measures Are in Place?

Protecting patient data is a legal and ethical requirement. Your billing company must follow strict protocols to secure Protected Health Information (PHI) across systems, users, and networks.

✅ Role-Based Access Control (RBAC)

- Access to PHI must be limited by role, department, and function

- Staff should only see data necessary for their job (minimum necessary rule)

- Admins should maintain access logs and permission change history

RBAC helps prevent unauthorized exposure of sensitive patient information.

✅ Business Associate Agreement (BAA)

- A valid, signed BAA must be included in all service contracts

- The BAA should define data usage, breach reporting, and subcontractor responsibilities

- Ensure the billing firm also holds BAAs with any third-party vendors they use

Without a BAA, your practice is liable for HIPAA violations caused by the vendor.

✅ Encryption in Transit and at Rest

All PHI must be encrypted:

- In transit via TLS 1.2 or higher

- At Rest, using AES-256 encryption or equivalent

Ensure secure protocols for file uploads, emails, and data exports.

Encryption protects data even in the event of system theft or interception.

✅ Multi-Factor Authentication (MFA)

Access to billing dashboards and EHR integrations should require:

- Password + time-based token or biometric login

- Regularly forced password resets

Disable inactive accounts and enforce session timeouts

MFA significantly reduces the risk of unauthorized system access.

✅ Penetration Testing and System Monitoring

1. Vendors should conduct annual penetration tests using independent auditors

2. Security logs must track:

- Login attempts

- IP address anomalies

- Data downloads and user activity

3. Look for vendors with a formal Incident Response Plan (IRP)

Regular testing ensures your vendor’s systems can resist evolving cyber threats.

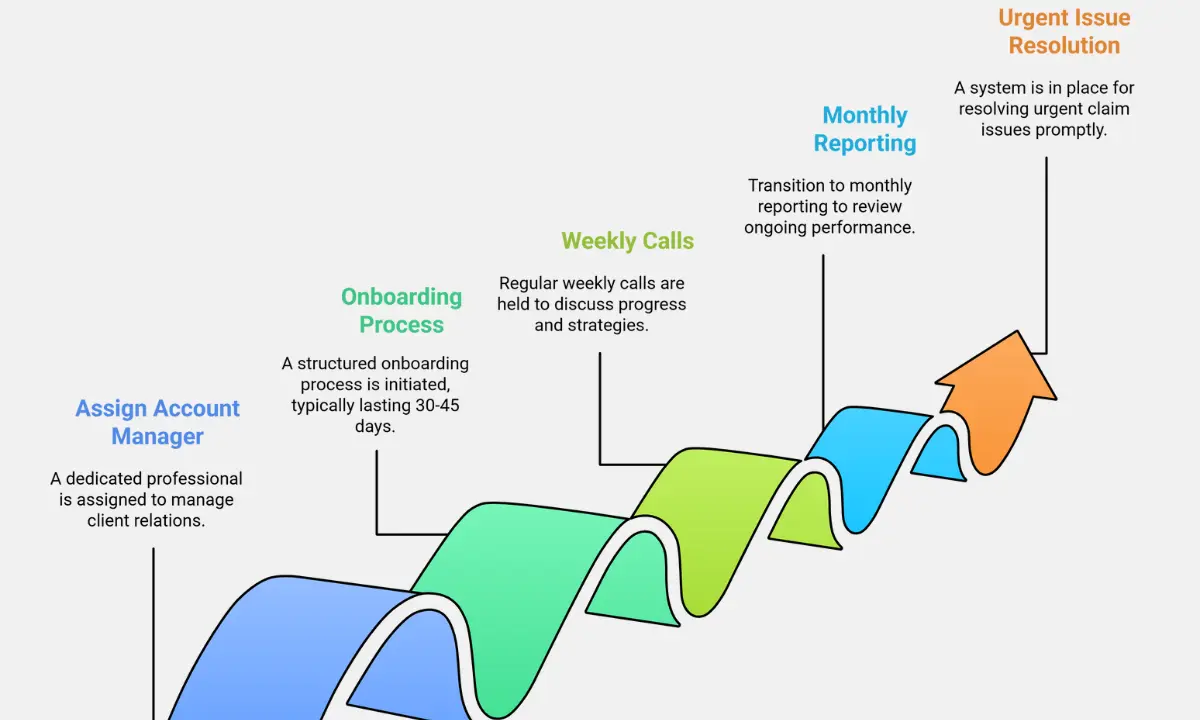

What’s the Billing Company’s Support and Onboarding Structure?

A reliable medical billing company provides structured onboarding and responsive support. You should assess how they assign responsibilities, manage timelines, and resolve issues.

Key Support Features to Prioritize

1. Assign a Dedicated Account Manager

You get one point of contact who oversees your billing operations, escalates issues, and maintains alignment with your goals.

2. Includes a Revenue Cycle Management (RCM) Strategist

This specialist analyzes your claim data, identifies revenue leakage, and recommends workflow optimizations based on CPT usage, payer trends, and denial rates.

3. Follows a Defined Onboarding Timeline (30–45 Days)

A professional vendor breaks the onboarding into phases:

- Data intake and EHR integration (Week 1–2)

- Payer credentialing and clearinghouse setup (Week 2–3)

- Test claims and compliance audits (Week 3–4)

- Live claim submission and ramp-up (Week 4–6)

4. Holds Weekly Ramp-Up Calls

During the first 4–6 weeks, expect weekly meetings to track KPIs like clean claim rate, days in A/R, and first-pass resolution rate.

5. Provides Ongoing Monthly Reporting

After go-live, they should deliver regular reports with metrics such as:

| Metric | Benchmark |

|---|---|

| Clean Claim Rate | ≥ 95% |

| Days in Accounts Receivable | < 35 days |

| First-Pass Resolution Rate | ≥ 85% |

6. Uses a Ticketing System or Direct Support Line

Critical claim issues should trigger high-priority workflows. Ensure there are:

- 24–48 hour response time on urgent tickets

- Direct phone or Slack channel for real-time coordination

What Makes MediBill RCM LLC a Strategic Billing Partner?

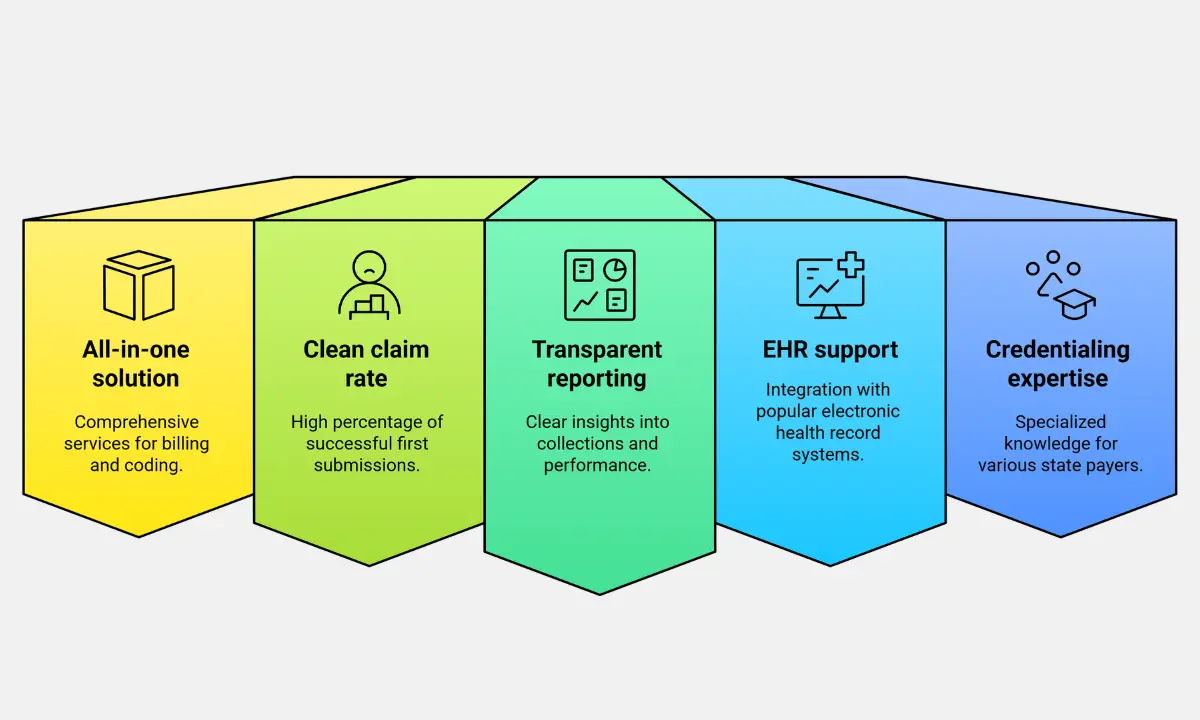

MediBill RCM LLC positions itself as a full-scope revenue cycle partner. Our service model emphasizes performance, transparency, and tech alignment, all essential for multi-specialty clinics and growing private practices.

Strategic Advantages of Choosing Us

1. Delivers an All-in-One RCM Solution

You get billing, coding, and credentialing under one roof. This reduces data silos, accelerates claim cycles, and minimizes errors from vendor handoffs.

2. Achieves a 98% Clean Claim Rate on the First Submission

MediBill RCM LLC maintains high accuracy through certified coders, payer rule engines, and pre-submission audits. A 98% rate minimizes rework and boosts cash flow.

3. Provides Transparent, Real-Time Reporting

You access a collections dashboard that displays the following:

- Claims aging buckets

- Denial trends by CPT or payer

- Daily collections vs. expected revenue

- This visibility helps your admin team respond faster to revenue risks.

4. Supports Direct EHR Integration

MediBill RCM LLC connects directly with major platforms:

- Kareo: Seamless scheduling-to-billing workflow

- Athenahealth: Native claim routing and reporting

- AdvancedMD: Bi-directional data sync and rules-based alerts

5. Employs Credentialing Experts with Payer-Specific Knowledge

Our credentialing team manages CAQH, payer contracts, and revalidations across state lines. This shortens enrollment time and prevents coverage gaps for multi-state providers.

Related Post: Medical Billing Process: The Comprehensive 11-Step Workflow Guide (+Free PDF)

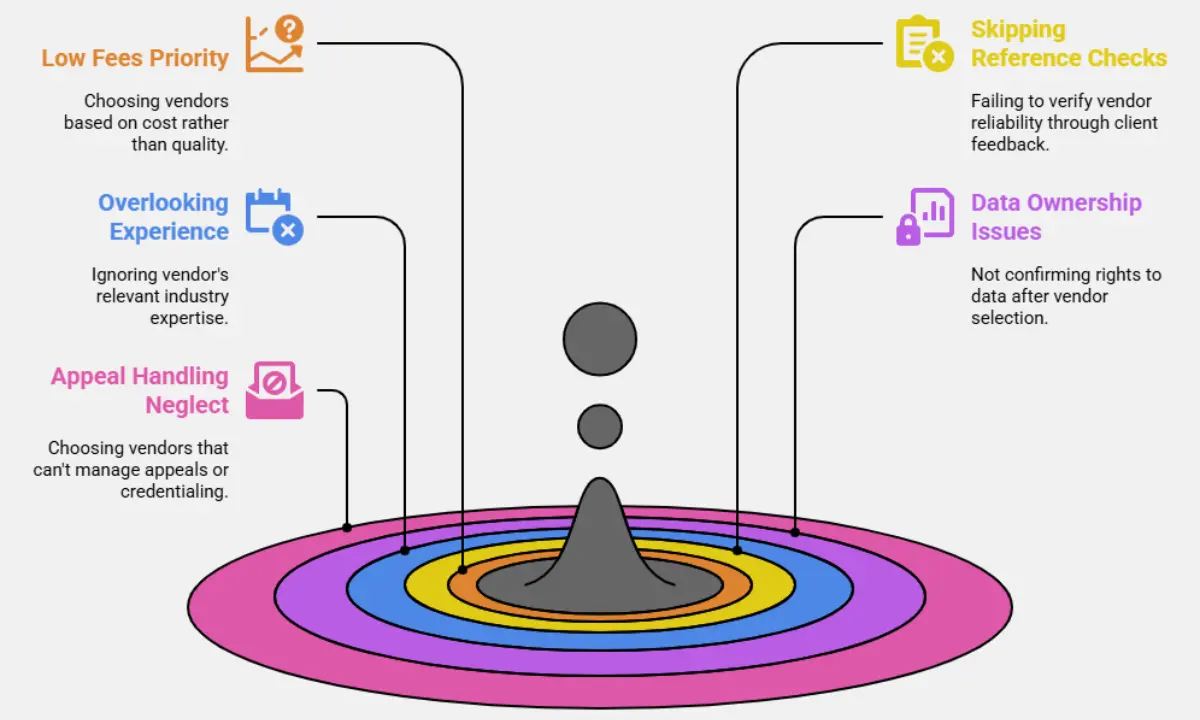

What Mistakes Do Practices Make When Choosing a Billing Vendor?

Many practices lose revenue and control by misjudging key billing vendor traits. Avoiding common pitfalls ensures you choose a partner that improves, not complicates, your operations.

Costly Mistakes to Avoid

1. Prioritizing Low Fees Over High Performance

A low % fee often hides poor metrics. If a vendor charges 2.49% but delivers only 85% collections, you lose more than with a 3.99% vendor achieving 98% recovery.

2. Skipping Reference Checks with Current Clients

Always request references from practices with similar sizes and specialties. Ask about claim turnaround time, denial handling, and issue responsiveness.

3. Overlooking Specialty-Specific Experience

Billing rules vary widely by specialty. If you’re in dermatology or orthopedics, for example, you need coders fluent in procedure modifiers, global periods, and payer edits relevant to your field.

4. Not Confirming Data Ownership Rights

Ensure your contract states that you retain full ownership of financial and patient data. A lack of clarity here can lock you into a vendor with no exit plan.

5. Choosing Firms That Don’t Handle Appeals or Credentialing

A billing partner should manage denials, file appeals, and assist with payer enrollment. If these aren’t included, your internal team absorbs extra workload and delays.

Pre-Contract Checklist: 15 Must-Ask Questions for Medical Billing Providers

- What is your clean claim rate?

- Do you support my specialty and state regulations?

- How do you manage rejections and denials?

- What’s your average A/R days for similar practices?

- Are your coders certified (CPC, CPB)?

- What billing platforms or EHRs do you integrate with?

- Who owns the billing data?

- Do you manage credentialing and re-credentialing?

- Can you support both Medicare and commercial payers?

- What level of reporting will I receive?

- Are you HIPAA audited and insured?

- What’s your claim turnaround time?

- Can I meet my account team in advance?

- What services are excluded from your base rate?

- What happens if I decide to exit?

FAQ: Choosing a Medical Billing Company

How long does onboarding typically take?

Onboarding usually takes 30–45 days. This includes EHR integration, data migration, clearinghouse setup, test claim submission, and workflow testing.

Can I switch billing providers mid-year?

Yes, mid-year transitions are possible. Ensure the vendor offers:

Full data export in CSV or HL7 format

Transition plan with minimal billing disruption

Historic A/R tracking and denied claim handoff

Do billing companies handle patient collections?

Some do, but terms vary. Ask if the service includes:

Patient statement mailing and phone follow-ups

Payment plan setup

Management of past-due balances

Are outsourced billing companies HIPAA-compliant?

Reputable vendors meet HIPAA standards. Look for:

Annual HIPAA compliance audits

Signed Business Associate Agreements (BAA)

Encrypted access controls and audit logs

Can they integrate with my existing EHR?

Most modern billing companies integrate with major EHRs via:

API connections (real-time data sync)

HL7 interfaces (batch data transfer)

Confirm platform compatibility and whether the integration is read-only or bi-directional.