Table of Contents

What Is a Medical Claim?

Medical claims play a crucial role in the healthcare system, acting as the bridge between healthcare providers and insurance companies.

They ensure providers receive payment for services rendered while allowing insurers to process and verify patient coverage.

Purpose of Medical Claims

A medical claim is a formal request for payment submitted by a healthcare provider to an insurance company or government payer (such as Medicare or Medicaid).

It details the medical services provided to a patient, along with corresponding codes and pricing information.

✅ Key Purposes of a Medical Claim:

- Ensures healthcare providers are reimbursed for medical services.

- Facilitates communication between providers, insurers, and patients.

- Helps insurance companies determine coverage eligibility and payment amounts.

- Maintains records for legal and regulatory compliance.

A well-processed medical claim helps healthcare providers avoid financial losses and ensures patients get the right insurance coverage. Mistakes in claims can cause denials, delays, and payment issues.

Key Differences Between Medical, Dental, and Pharmacy Claims

All healthcare claims aim to get reimbursement for services, but they vary in structure, coding, and processing systems:

| Claim Type | Purpose | Common Codes Used | Processing System |

|---|---|---|---|

| Medical Claims | Covers physician visits, hospital stays, surgeries, diagnostic tests, and therapies. | CPT, ICD, HCPCS | Processed through insurers, Medicare, Medicaid, or private payers. |

| Dental Claims | Includes oral exams, extractions, root canals, orthodontics, and prosthetics. | CDT (Current Dental Terminology) | Often processed separately from medical claims, requiring dental-specific coverage. |

| Pharmacy Claims | Covers prescription medications and sometimes over-the-counter drugs. | NDC (National Drug Codes) | Processed through PBMs (Pharmacy Benefit Managers) or insurance companies. |

✅ Key Takeaways:

- Separate coding: Medical and dental claims use distinct code sets (CPT vs. CDT).

- Real-time vs. delayed: Pharmacy claims resolve instantly at checkout; medical/dental claims take days to weeks.

- Specialized systems: PBMs handle pharmacy claims, while insurers manage medical/dental.

- Accuracy matters: Understanding these differences reduces claim rejections and delays.

Managing medical claims in-house requires significant resources.

Our specialized team can handle your Medical billing, coding and credentialing at just 3.99% of collections. [Learn how we can help your practice]

Anatomy of a Medical Claim: Breaking Down the Components

A medical claim is a detailed document with information about a patient’s treatment, the healthcare provider, and the necessary codes for insurance reimbursement. Knowing its components helps providers prevent mistakes, reduce denials, and speed up payments.

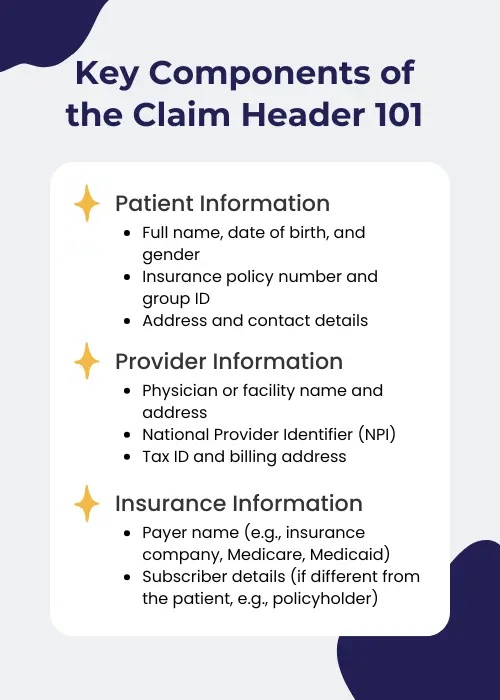

Claim Header: Patient and Provider Identification

The claim header is the first section of a medical claim. It contains essential information to identify the patient, provider, and insurer, ensuring the claim is accurately linked to the correct individual and facility.

Key Components of the Claim Header:

✅ Patient Information:

- Full name, date of birth, and gender

- Insurance policy number and group ID

- Address and contact details

✅ Provider Information:

- Physician or facility name and address

- National Provider Identifier (NPI)

- Tax ID and billing address

✅ Insurance Information:

- Payer name (e.g., insurance company, Medicare, Medicaid)

- Subscriber details (if different from the patient, e.g., policyholder)

Accurate provider identification requires understanding whether you’re listing the rendering provider (who delivered care) or billing provider (entity submitting claims). For details, see our complete guide to rendering providers vs billing providers.

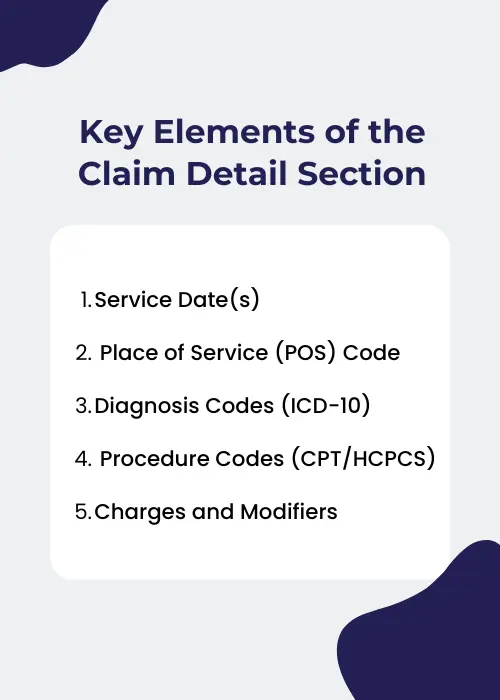

Claim Detail: Services, Diagnoses, and Procedures

The claim detail section outlines the medical services provided to the patient, including procedures, diagnoses, and treatment dates. This section is critical for reimbursement, as insurers evaluate the medical necessity of services based on this data.

Key Elements of the Claim Detail Section:

- Service Date(s): Specifies when the medical services were performed.

- Place of Service (POS) Code: Indicates where the treatment was provided (e.g., hospital, physician’s office, telehealth).

- Diagnosis Codes (ICD-10): Identify the medical condition(s) being treated.

- Procedure Codes (CPT/HCPCS): Specify the treatment, tests, or surgeries performed.

- Charges and Modifiers: Shows the cost of services and any relevant modifiers that affect billing.

By ensuring accurate and complete claim details, providers can prevent unnecessary denials and delays in payment processing.

Medical Codes: ICD, CPT, and HCPCS

Medical claims use special codes to tell insurance companies about a patient’s diagnosis, treatments, and care. Below are the three central coding systems used:

| Code System | What It Does | Examples |

|---|---|---|

| ICD-10 (International Classification of Diseases) | Describes the patient’s diagnosis or medical condition. | E11.9 (Type 2 Diabetes), J45.909 (Asthma) |

| (Current Procedural Terminology) | Lists medical procedures or services (e.g., tests, surgeries). | 99213 (Office Visit), 93000 (Electrocardiogram) |

| HCPCS (Healthcare Common Procedure Coding System) | Covers medical equipment, medications, and non-doctor services. | J3490 (Unclassified Drugs), E0114 (Crutches) |

Why Coding Matters:

- Ensures claims are billed correctly

- Reduces denials from coding mistakes

- Helps insurers decide payment amounts

EOB vs. Medical Claim: Key Differences

| Aspect | Explanation of Benefits (EOB) | Medical Claim |

|---|---|---|

| Sent By | Insurance company to the patient. | Healthcare provider to the insurance company. |

| Purpose | Explains coverage, payments, and patient responsibility. | Requests payment for services rendered. |

| Key Components | – Total billed amount – Allowed amount – Insurance payment – Patient responsibility | – Treatment details – Diagnosis codes – Procedure codes – Charges |

| Notes | Not a bill, just a summary of what was paid/owed. | Must be accurate to avoid denials/delays. |

Breakdown of an EOB

| Term | Description |

|---|---|

| Total Billed Amount | What the healthcare provider charged for the service. |

| Allowed Amount | The maximum amount the insurance company agrees to pay for the service. |

| Insurance Payment | What the insurer actually paid toward the service. |

| Patient Responsibility | What the patient owes (e.g., copay, deductible, or non-covered services). |

Why It Matters:

- Helps patients avoid paying unnecessary bills.

- Clarifies how much the insurer covers vs. what the patient pays.

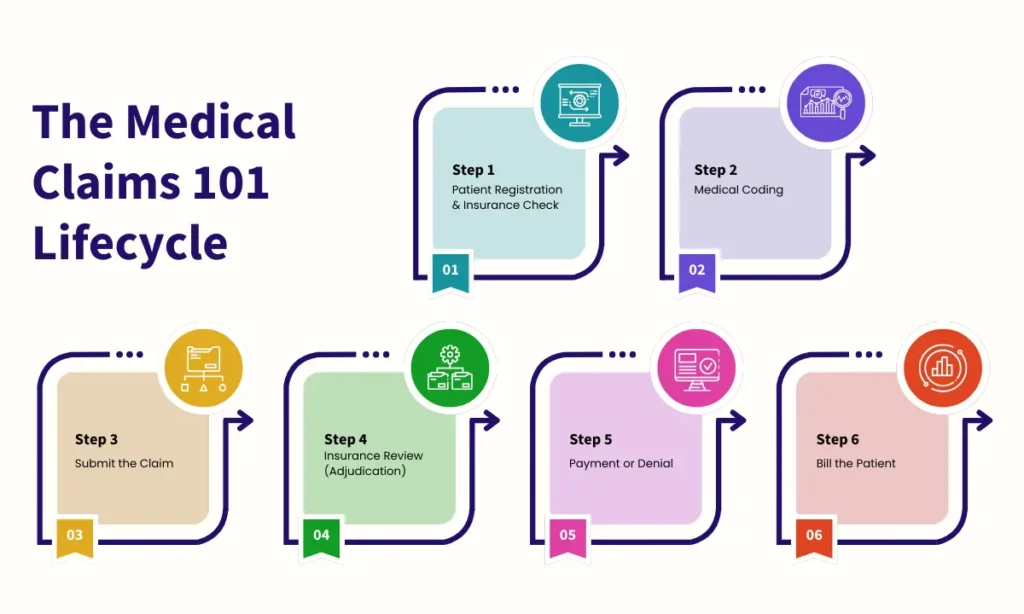

The Medical Claims Lifecycle: From Registration to Payment

Medical claims follow a step-by-step process from the patient’s first visit to the final payment. Knowing these steps helps providers avoid delays, reduce denials, and get paid faster.

Step 1: Patient Registration & Insurance Check

Goal: Collect patient/insurance details to avoid billing errors.

✅ Key Actions:

- Gather patient info: Name, birthdate, contact info.

- Check insurance: Is their plan active? What do they owe (deductibles, copays)?

- Pre-approvals: Does their treatment need prior approval from insurance?

- Explain costs: Tell the patient what they’ll pay out-of-pocket.

Why It Matters:

- Stops denials from wrong insurance details.

- No surprises for patients about costs.

Step 2: Medical Coding

Goal: Turn treatment notes into codes for billing.

✅ Codes Used:

- ICD-10 Codes: Describe the patient’s illness (e.g., diabetes, asthma).

- CPT Codes: List treatments or tests (e.g., office visits, X-rays).

- HCPCS Codes: Cover equipment or special services (e.g., crutches, ambulance).

🚫 Common Coding Mistakes:

- Missing/wrong codes → Claim rejected.

- Unbundling: Billing separate services that should be grouped.

- Upcoding/Downcoding: Using wrong codes to charge more/less.

Why It Matters:

- Correct codes = correct payment.

- Avoids legal issues or fines.

Step 3: Submit the Claim

Goal: Send error-free claims to insurance.

✅ Two Ways to Submit:

| Via Clearinghouse | Direct to Insurance |

|---|---|

| – Middleman checks for errors first. | – Send claims straight to insurer. |

| – Catches mistakes early. | – Faster, but needs expert staff. |

| – Best for small/mid-size offices. | – Used by large hospitals/clinics. |

Why It Matters:

- Fewer denials and delays.

Learn more: Timely Filing Limit for Claims in Medical Billing

Step 4: Insurance Review (Adjudication)

Goal: Insurance decides what to pay.

✅ How It Works:

- First Check: Is the claim complete? Does the plan cover this service?

- Medical Necessity: Was the treatment needed?

- Pricing: Apply discounts from provider-insurer contracts.

- Decision: Pay, deny, or ask for more info.

Why It Matters:

- Fast review = faster payment.

Step 5: Payment or Denial

Goal: Get paid or fix denied claims.

✅ If Approved:

- The insurer pays via check or direct deposit.

- Bill the patient for their share.

🚫 If Denied:

- Find out why (e.g., wrong code, missing info).

- Fix errors and send the claim again.

- Appeal if the denial is unfair.

When claims are denied, prompt action is crucial. For an expanded list of denial reasons beyond these six – including technical rejections and authorization problems – consult our complete resource: 10 Common Reasons for Medical Billing Denials and How to Prevent Them.

Why It Matters:

- Fixing denials quickly = less lost money.

Step 6: Bill the Patient

Goal: Collect remaining payments.

✅ How to Do It:

- Send a clear bill showing insurance payments and the patient’s share.

- Offer payment plans for large bills.

- Send reminders or use collections if bills aren’t paid.

Why It Matters:

- Patients know what they owe.

- Providers get paid faster.

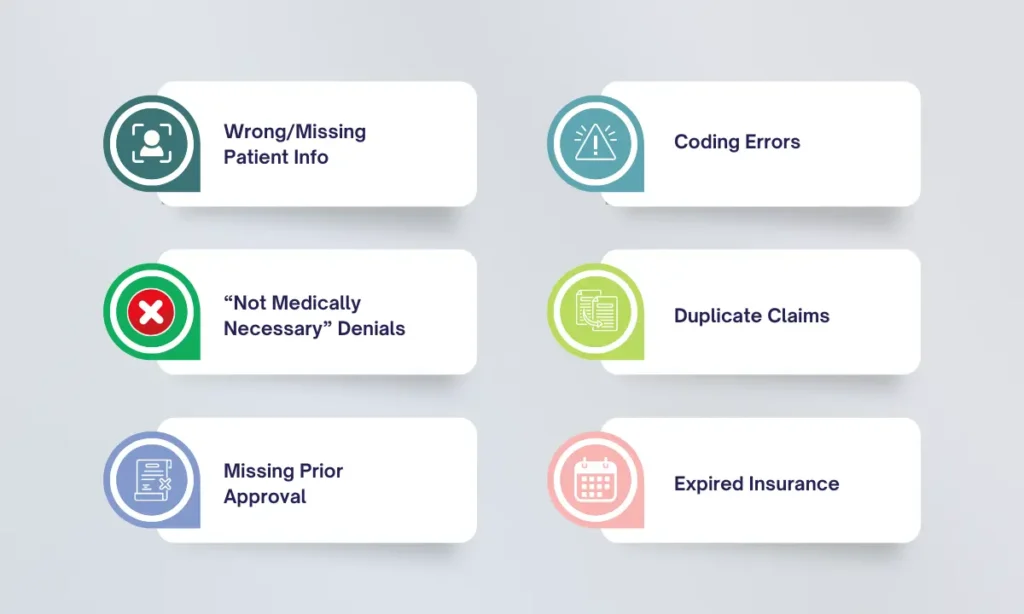

Top 6 Reasons Medical Claims Get Denied (And How to Solve Them Fast)

Healthcare claims processing is often complex and challenging. The claims frequently get denied or delayed due to errors, outdated info, or insurance rules. Here’s how to tackle the most significant issues:

1. Wrong/Missing Patient Info

🚫 Problem: Typos in names, birthdates, or insurance IDs.

✅ Fix: Double-check details during registration. Automated tools are used to verify insurance in real-time.

2. Coding Errors

🚫 Problem: Wrong ICD-10, CPT, or HCPCS codes (e.g., mismatched diagnosis and procedure codes).

✅ Fix:

- Train coders regularly.

- Use coding software with built-in error alerts.

- Audit claims before submitting.

3. “Not Medically Necessary” Denials

🚫 Problem: Insurer rejects claims, saying treatment wasn’t needed.

✅ Fix:

- Document why the service was necessary (e.g., symptoms, test results).

- Check the insurer’s coverage rules beforehand.

4. Duplicate Claims

🚫 Problem: Accidentally sending the same claim twice.

✅ Fix: Track claims in a dashboard. Follow up on pending claims before resubmitting.

5. Missing Prior Approval

🚫 Problem: No pre-approval for services that require it (e.g., surgeries, MRIs).

✅ Fix: Always verify prior authorization requirements before performing services.

6. Expired Insurance

🚫 Problem: The patient’s coverage lapsed before the visit.

✅ Fix: Run real-time eligibility checks at every appointment.

How to Stop Denials Before They Happen

✔️ Use Tech Tools: EHR and RCM systems flag errors automatically.

✔️ Audit Claims: Review 5-10% of claims weekly to catch mistakes.

✔️ Train Staff: Hold monthly coding/billing workshops.

✔️ Appeal Fast: Appeal denials within 7 days to avoid missed deadlines.

Reduce denials and improve cash flow with our Expert Medical Billing Services. We help practices increase collections while reducing administrative burdens – all for just 3.99%. [Schedule a consultation today].

Timelines: How Long Do Insurers Have to Pay Claims?

Healthcare providers rely on timely payments to keep their practices running. Here’s how long insurers typically take to pay claims and how to avoid delays.

Standard Payment Timelines

| Payer | Timeframe |

|---|---|

| Medicare | 30 days for error-free (“clean”) claims. |

| Medicaid | 30–45 days (varies by state). |

| Private Insurance | 30–45 days (depends on contract terms). |

| Electronic Claims | 14–21 days (faster than paper). |

| Paper Claims | 30+ days (slower due to manual processing). |

Why Payments Get Delayed

🔴 Common Reasons:

- Mistakes in the claim (e.g., wrong codes, missing patient info).

- Paper claims take longer to process than electronic ones.

- Extra reviews for expensive or unusual treatments.

- Outdated insurer policies (e.g., prior authorization rules you didn’t follow).

How to Get Paid Faster

✅ Pro Tips for Providers:

- Submit error-free claims: Double-check codes, patient details, and documentation.

- Go electronic: Use EHR systems or clearinghouses to file claims digitally.

- Track claims: Check claim status weekly using payer portals.

- Fix errors fast: If a claim is denied, correct and resubmit it within 5 days.

- Know the rules: Review payer contracts for deadlines and requirements.

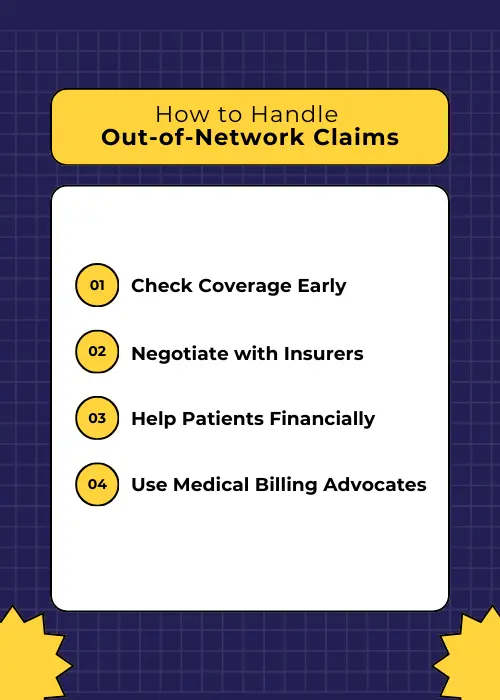

Out-of-Network Claims: Challenges & How to Manage Them

Out-of-network claims are one of the biggest challenges in medical billing. When a provider is not contracted with a patient’s insurance plan, reimbursement rates are lower, and patients often face higher costs.

Why Out-of-Network Claims Are Hard

🔴 Key Challenges:

| Issue | Impact |

|---|---|

| Higher Costs for Patients | Patients pay more (e.g., 40–60% vs. 20% in-network). |

| Lower Reimbursement | Insurers pay less, leaving providers underpaid. |

| Prior Authorization Hurdles | Extra approvals needed for out-of-network care. |

| Balance Billing Risks | Patients get stuck paying the unpaid balance. |

How to Handle Out-of-Network Claims

✅ Practical Solutions:

Check Coverage Early

- Confirm the patient’s out-of-network benefits before treatment.

- Explain costs upfront to avoid disputes.

Negotiate with Insurers

- Ask for a single-case agreement (one-time contract for specific care).

Help Patients Financially

- Offer payment plans or discounts for upfront payments.

Use Medical Billing Advocates

- Professionals can help negotiate higher reimbursements from insurers.

Surprise Billing Protections

No Surprises Act (NSA): The federal law protects patients from unexpected out-of-network charges, ensuring they are not overbilled for emergency or certain non-emergency services.

Before submitting out-of-network claims, ensure proper credentialing with the payer. Each insurer has unique enrollment requirements. To navigate this complex process efficiently, review our comprehensive Guide to National & State-Specific Insurance Payers with Credentialing Policies.

Regulatory Compliance in Medical Claims Processing

Medical claims processing follows strict rules to protect data, prevent fraud, and comply with federal and state laws. Healthcare providers, insurers, and billing professionals must follow these rules to avoid penalties, legal issues, and claim denials.

HIPAA and Patient Data Security

The Health Insurance Portability and Accountability Act (HIPAA) is a cornerstone of healthcare compliance. It protects patient information and ensures secure electronic transactions in medical claims processing.

Key HIPAA Rules for Claims Processing

| Rule | What It Means |

|---|---|

| Privacy Rule | Only share patient health info (e.g., diagnoses, treatments) with authorized staff. |

| Security Rule | Protect digital patient data with tools like encryption and password controls. |

| EDI Standards | Submit claims in HIPAA-approved electronic formats (no paper/email unless secure). |

Common HIPAA Mistakes to Avoid

- Sending claims via insecure methods (e.g., regular email, unencrypted fax).

- Let unauthorized staff view patient records (e.g., billing staff accessing treatment notes they don’t need).

- Skipping annual security checks (e.g., not testing for data leaks).

How to Stay Compliant

✅ Use Secure Tools:

- Encrypt emails and claims (think of it as scrambling data so hackers can’t read it).

- Choose HIPAA-certified EHR and billing software.

✅ Train Your Team:

- Teach staff what patient data they can/can’t share.

- Role-play handling accidental breaches (e.g., misdirected faxes).

✅ Audit Regularly:

- Check systems yearly for security gaps.

- Update passwords and access permissions.

Why It Matters

- Fines for violations: Up to $1.5 million per year for repeated issues.

- Reputation damage: Patients lose trust if their data is exposed.

Related Post: Medical Billing Compliance Checklist

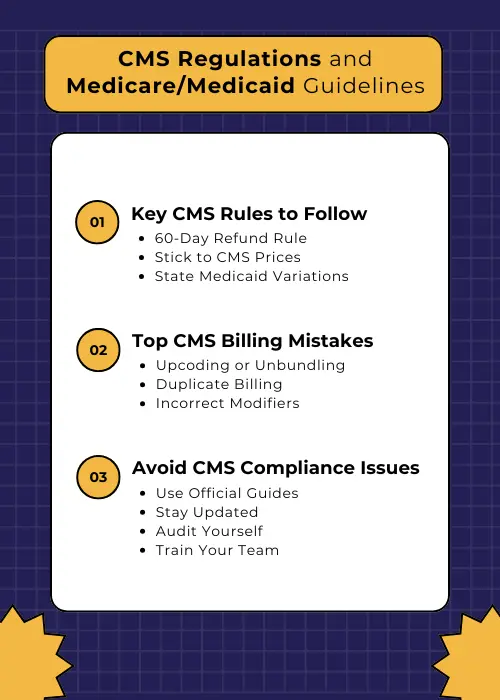

CMS Regulations and Medicare/Medicaid Guidelines

The Centers for Medicare & Medicaid Services (CMS) oversees claims processing for Medicare and Medicaid, enforcing strict guidelines on billing, reimbursements, and audits.

Key CMS Rules to Follow

- 60-Day Refund Rule: If CMS overpays you, return the money within 60 days of finding the error.

- Stick to CMS Prices: Charge only what Medicare/Medicaid allows (no markups).

- State Medicaid Variations: Each state has unique Medicaid billing rules, requiring providers to stay updated.

Top CMS Billing Mistakes

- Upcoding or Unbundling: Billing for more expensive procedures than performed.

- Duplicate Billing: Submitting the same claim multiple times.

- Incorrect Modifiers: Using the wrong coding modifier for a procedure.

How to Avoid CMS Compliance Issues

- Use Official Guides: Follow CMS’s Medicare Claims Processing Manual and your state’s Medicaid handbook. Example: CMS’s MCD lookup tool checks if a service is covered.

- Stay Updated: Subscribe to CMS email updates or attend annual billing webinars.

- Audit Yourself: Review 5–10% of claims monthly for errors like: Wrong codes, Missing prior authorization, and Incorrect patient eligibility.

- Train Your Team: Hold quarterly workshops on CMS rule changes.

Why It Matters (Penalties for Non-Compliance)

- Fines up to $10,000 per claim for fraud.

- Ban from Medicare/Medicaid programs (huge revenue loss).

Fraud Prevention and Compliance Audits

Healthcare fraud drains billions yearly. Protect your practice with these compliance basics.

Common Types of Medical Billing Fraud

| Fraud Type | Example | Risk Level |

|---|---|---|

| Phantom Billing | Billing for an MRI the patient never had. | 🚩 High (Audit trigger) |

| Kickbacks | Paying a clinic $50 for each patient referral. | 🚩 High (Illegal under Anti-Kickback Statute) |

| Unnecessary Services | Ordering costly blood tests for a healthy patient. | 🚩 Medium |

How the Government Catches Fraud

| Program/Law | What It Does | Penalties |

|---|---|---|

| False Claims Act (FCA) | Fines providers for lying on claims (e.g., upcoding). | Up to 3x the fraud amount + $11k per claim |

| OIG Audits | Investigates Medicare/Medicaid fraud. | Fines, prison, exclusion from federal programs |

| RAC Audits | Recovers improper Medicare payments. | Repayment + interest |

How to Prevent Fraud in Claims Processing:

- Use Fraud-Detection Tools

- Keep Detailed Records

- Train Staff Annually

- Audit Claims Monthly

Consequences of Non-Compliance

- Fines: Up to $100k per FCA violation.

- Prison: Up to 5 years for kickbacks.

- Practice Ruin: Losing Medicare/Medicaid eligibility.

Federal vs. State Regulations: Key Differences and Challenges

Medical billing must follow federal laws (applying nationwide) and state-specific rules (varying by location). Here’s how to navigate both:

Federal vs. State Rules Compared

| Aspect | Federal Rules | State Rules |

|---|---|---|

| Privacy Laws | HIPAA protects all patient data. | Some states add stricter rules (e.g., California’s CCPA for data sharing). |

| Medicaid | CMS sets baseline requirements. | Each state decides eligibility, coverage, and payment rates (e.g., Texas vs. New York). |

| Surprise Billing | No Surprises Act bans most unexpected bills. | States like Florida and Texas have extra balance billing protections. |

| Claim Payment Deadlines | Medicare pays in 30 days for clean claims. | States set deadlines for private insurers (e.g., 30 days in California, 45 days in Illinois). |

Biggest Challenges with State Laws

Medicaid Headaches:

- Example: A service covered in Ohio might be denied in Georgia.

- Fix: Check your state’s Medicaid handbook before billing.

Extra Privacy Rules:

- Example: New York’s SHIELD Act requires stricter data breach reporting than HIPAA.

- Fix: Update consent forms and IT security for strict states.

Conflicting Laws:

- Example: A state’s surprise billing law might clash with federal NSA rules.

- Fix: Always follow the stricter rule (e.g., use federal NSA for emergencies).

How to Stay Compliant

Federal Compliance Tips:

- Follow HIPAA and CMS guidelines.

- Use CMS’s Medicare Learning Network for updates.

State Compliance Tips:

- Subscribe to your state’s Medicaid bulletins (e.g., Texas Medicaid).

- Use billing software with state-specific rules (e.g., Waystar or Athenahealth).

When in Doubt:

- Consult a healthcare attorney for multi-state billing.

Innovations Transforming Medical Claims Processing

The medical claims industry is undergoing a technological revolution. Artificial Intelligence (AI), machine learning, blockchain, and automation are streamlining claims workflows, reducing errors, and improving efficiency. These innovations are helping healthcare providers, payers, and patients navigate the complex billing landscape with greater accuracy and speed.

How AI and ML Improve Claims Processing

Top Ways AI/ML Improves Claims

Automated Claims Scrubbing

- What it does: AI checks claims for missing info or coding errors (e.g., wrong ICD-10 codes).

- Result: Fewer denials from avoidable mistakes.

Predictive Denial Alerts

- What it does: ML learns from past denials to warn you about risky claims (e.g., missing prior authorization).

- Result: Fix issues before submitting claims.

Faster Claim Reviews

- What it does: AI helps insurers verify coverage and codes in seconds, not days.

- Result: Payments hit your account faster.

Fraud Detection

- What it does: AI spots odd patterns (e.g., 100 flu shots billed in 1 hour).

- Result: Blocks fake claims and saves money.

Why This Matters for Your Practice

- Less paperwork: AI handles repetitive tasks, freeing up your team.

- Faster cash flow: Claims get approved in days, not weeks.

- Fewer denials: Fix errors upfront instead of fighting rejections.

- More revenue: Stop losing money to fraud or coding mistakes.

Top Medical Claims Software: Features & Best Fit

Choosing the right claims software reduces errors, speeds up payments, and keeps you compliant.

Software Comparison

| Software | Key Features | Best For |

|---|---|---|

| Kareo | ✅ Cloud-based billing ✅ Automated claims scrubbing | Small to mid-sized practices |

| Waystar | ✅ AI-driven analytics ✅ Denial management | Large hospitals & health systems |

| AdvancedMD | ✅ EHR + billing integration ✅ Eligibility checks | Multi-specialty clinics |

| Change Healthcare | ✅ Real-time tracking ✅ Payer network integration | Hospitals & enterprise-level providers |

| Athenahealth | ✅ Automated submissions ✅ Insurance verification | Small practices & solo providers |

Blockchain in Medical Claims: Secure, Transparent, and Efficient

Blockchain is reshaping medical claims by tackling fraud, delays, and inefficiencies.

How Blockchain Fixes Claims Processing

| Benefit | How It Works | Example |

|---|---|---|

| No Fraud or Tampering | Claims data is locked in unchangeable blocks. | Prevents altering diagnoses or billing codes post-submission. |

| Instant Approvals | Smart contracts (auto-check rules) approve valid claims in seconds. | A flu shot claim meeting all criteria is paid automatically. |

| Secure Data Sharing | All parties (doctors, insurers, patients) access the same verified data. | A hospital shares X-ray results securely with an insurer. |

| Cut Costs | Removes middlemen (e.g., claims clearinghouses). | Saves 10–10–15 per claim in manual checks. |

Challenges to Adoption

Regulatory Hurdles

- Issue: HIPAA and CMS rules aren’t fully adapted to blockchain.

- Fix: Work with compliance experts to align with privacy laws.

High Startup Costs

- Issue: Building blockchain systems is pricey for small clinics.

- Fix: Use cloud-based blockchain services (pay-as-you-go).

Why This Matters

| For Providers | For Insurers | For Patients |

|---|---|---|

| Fewer denied claims. | Faster fraud detection. | No surprise bills. |

| Lower admin costs. | Reduced processing costs. | Control over health data. |

Robotic Process Automation (RPA) in Claims: Faster, Smarter, Cheaper

RPA uses software “bots” to automate repetitive tasks in claims processing, cutting errors and speeding up workflows.

How RPA Fixes Claims Processing

✅ Automated Data Entry

- What it does: Bots pull data from forms or EHRs and enter it into billing systems.

- Result: 99% accuracy, no typos in patient IDs or codes.

✅ 24/7 Claims Tracking

- What it does: Bots check claim statuses daily and flag delays.

- Result: No more missed follow-ups or unpaid claims.

✅ Instant Claim Fixes

- What it does: Bots auto-correct denied claims (e.g., missing codes) and resubmit them.

- Result: Denials resolved in hours, not weeks.

Challenges to Know

Costly Setup

- Issue: Building custom bots is expensive.

- Fix: Start small and automate one task (e.g., eligibility checks).

Tech Compatibility

- Issue: Bots may not work with older billing systems.

- Fix: Use cloud-based RPA tools (e.g., UiPath, Automation Anywhere).

Why RPA Matters

| For Providers | For Insurers |

|---|---|

| Saves 10+ hours/week on paperwork. | Processes claims 5x faster. |

| Reduces denials by 25–40%. | Cuts labor costs by 30–50%. |

Stay ahead of industry changes without the overhead. Our technology-driven billing solutions combine the latest innovations with expert oversight at competitive rates. [Discover our 3.99% solution].

How to Read and Appeal a Medical Claim

Receiving a medical bill or an Explanation of Benefits (EOB) can be confusing, especially when claims are denied or only partially covered. Understanding how to read your claim documents and knowing your rights to appeal can help you avoid overpaying and ensure you receive the benefits you’re entitled to.

How to Read Your Explanation of Benefits (EOB)

An EOB is not a bill, it’s a summary of how your insurance processed a claim. Here’s what to check:

| Section | What It Means | Red Flags 🚩 |

|---|---|---|

| Patient Info | Your name, policy number, service date. | Typos in name/ID → claim mismatch. |

| Services Rendered | Procedures/tests billed by the provider. | Services you didn’t receive. |

| Billed Amount | What the provider charged. | Compare to your bill for consistency. |

| Allowed Amount | What your insurer agrees to pay. | Lower than expected? Likely out-of-network. |

| Insurance Payment | What the insurer paid the provider. | $0? Check denial codes (e.g., CO-97). |

| Your Responsibility | What you owe (copay, deductible, coinsurance). | Higher than expected? Appeal! |

Common Denial Codes & Fixes

| Code | Reason | What to Do |

|---|---|---|

| CO-97 | Service not covered by your plan. | Check plan documents → ask provider to resubmit with correct codes. |

| CO-29 | Claim filed late. | Provider must refile ASAP (appeal if they missed deadline). |

| PR-1 | Deductible not met. | Confirm deductible status with insurer. |

| CO-16 | Missing/inaccurate info. | Call provider to correct and resubmit. |

The Appeals Process: Steps to Contest a Denied Claim

You can appeal if your claim is denied or you’re charged more than expected. Appeals can lead to reimbursement adjustments, claim approvals, or reduced patient responsibility.

Step 1: Understand the Denial Reason

- Check your EOB for denial codes and explanations.

- Contact your insurance provider for further clarification.

Step 2: Gather Documentation

- Collect medical records, doctor’s notes, itemized bills, and policy documents.

- Request a letter of medical necessity from your doctor if needed.

Step 3: File an Internal Appeal

Submit a written appeal letter to your insurance company, including:

- Your policy number & claim details.

- The reason you believe the denial was incorrect.

- Supporting documentation.

- Most insurers have a 30–60-day window for filing appeals.

Step 4: Request an External Review (if Needed)

- If the internal appeal is denied, you can request an independent external review by a third party.

- This option is available under the Affordable Care Act (ACA). It must be completed within four months of the final denial.

Step 5: Follow Up Regularly

- If unresolved, consider filing a complaint with your state’s insurance department.

- Keep track of your claim status and escalate the issue if delays occur.

Legal Rights: Understanding the Affordable Care Act and ERISA

Patients have legal protections when it comes to medical billing, appeals, and insurance disputes. Two key laws that govern these rights are the Affordable Care Act (ACA) also known as Obamacare and the Employee Retirement Income Security Act (ERISA).

ACA vs. ERISA: Patient Rights

| Key Feature | Affordable Care Act (ACA) | ERISA (Employer Plans) |

|---|---|---|

| Appeal Rights | ✅ Internal + external appeals required. | ✅ Internal appeals only (unless plan voluntarily offers external). |

| Timelines | Insurers must decide appeals within 30 days (72 hours for urgent care). | Same as ACA for urgent care; 45 days for standard appeals. |

| Surprise Billing Protections | Bans out-of-network charges for emergencies and certain non-emergency care. | No federal protections (depends on state laws). |

| Pre-Existing Conditions | Insurers cannot deny coverage or claims. | Applies if plan complies with ACA (most employer plans do). |

| Legal Recourse | Complaints to state insurance departments or CMS. | Lawsuits allowed for wrongful denials. |

| Example Violation | Insurer denies coverage for a preventive colonoscopy. | Employer plan delays surgery approval past 30 days. |

| How to Enforce Rights | 1. File complaint with state insurance department. 2. Escalate to CMS if unresolved. | 1. Request plan documents. 2. File complaint with U.S. DOL. 3. Sue in federal court. |

When to Use Each Law

| Scenario | ACA | ERISA |

|---|---|---|

| Insurance Type | Individual, marketplace, or Medicaid. | Employer-sponsored health plans. |

| Common Issues | Surprise bills, preventive care denials. | Delays, withheld documents, benefit cuts. |

| Best Enforcement Step | State insurance complaint. | U.S. Department of Labor complaint. |

Payers: Adjudication Rules and Transparency

Insurance companies (payers) are crucial in processing and evaluating claims. Based on policy guidelines and contract agreements with providers, they determine how much of a claim will be reimbursed.

Medical Claims Adjudication Process: Step-by-Step

| Adjudication Step | Description | Purpose |

|---|---|---|

| Claim Validation | Verifies all required fields (e.g., patient ID, provider details, codes) are complete and accurate. | Ensures claims meet basic submission criteria to avoid rejections. |

| Eligibility & Coverage Check | Confirms the patient’s insurance is active and the service is covered under their plan. | Prevents denials due to lapsed coverage or non-covered services. |

| Medical Necessity Review | Assesses if the service aligns with clinical guidelines and is justified by the diagnosis. | Ensures care is appropriate and reduces unnecessary costs. |

| Pricing & Contractual Adjustments | Applies negotiated rates, deductibles, and copays to calculate the insurer’s payment. | Determines the final reimbursable amount based on provider contracts. |

| Final Payment/Denial Decision | Approves, adjusts, or denies the claim based on the adjudication results. | Delivers a clear outcome (payment, partial payment, or denial). |

Key Responsibilities of Payers

| Responsibility | Description | Key Requirements |

|---|---|---|

| Compliance | Adhere to federal/state laws (e.g., HIPAA, ACA, ERISA). | Safeguard patient data, cover essential health benefits, avoid discriminatory practices. |

| Transparency | Provide clear denial reasons and payment policies. | Share fee schedules, prior authorization rules, and appeal processes with providers/patients. |

| Appeals Process | Offer a structured way to dispute denials. | Allow internal appeals (30–60 days) and external reviews (if required by law). |

| Timely Payments | Process claims within regulatory deadlines. | Medicare: 30 days; Medicaid: 30–45 days; private insurers: per state laws. |

Patient Guide: Navigating Medical Claims & Responsibilities

Understanding your role in the medical claims process helps avoid surprises, reduce costs, and resolve disputes efficiently. Here’s a breakdown of key responsibilities and common challenges, with actionable solutions.

Key Responsibilities of Patients

| Responsibility | What to Do |

|---|---|

| Understand Your Insurance Plan | Review your policy’s coverage, deductibles, copays, and out-of-pocket maximums. Ask your insurer for a summary of benefits. |

| Provide Accurate Information | Double-check personal/insurance details (name, DOB, policy number) at every visit. |

| Review EOBs & Bills | Compare the insurer’s Explanation of Benefits (EOB) with the provider’s bill for errors. |

| Appeal Denied Claims | Submit a written appeal with supporting documents (e.g., medical records, doctor’s notes). |

| Manage Out-of-Pocket Costs | Pay copays at the time of service and settle balances promptly to avoid collections. |

Common Patient Challenges & Solutions

| Challenge | Why It Happens | How to Fix It |

|---|---|---|

| Surprise Billing | Out-of-network providers in emergencies or at in-network facilities. | Use the No Surprises Act to dispute charges. Demand a Good Faith Estimate before non-emergency care. |

| Unclear Claim Denials | Insurers may use vague codes (e.g., “CO-97: Service not covered”). | Call your insurer for specifics. Example: “Can you explain denial code CO-97?” |

| EOB vs. Bill Confusion | EOBs look like bills but are not. | Wait for the provider’s bill. If amounts differ, contact both provider and insurer. |

| Delayed Refunds | Slow processing by providers or insurers. | Request a timeline in writing. Escalate to your state insurance department if delayed beyond 30 days. |

Focus on patient care while we handle your revenue cycle management. Our proven billing and coding services start at just 3.99% with no long-term contracts. [Contact us today to get started]

FAQs: Your Medical Claims Questions Answered

What Is a Clean Claim?

A clean claim is an entirely accurate and error-free submission that includes all necessary documentation, such as correct patient demographics, verified insurance details, and adequately aligned medical codes (e.g., CPT, ICD-10, HCPCS). Insurers process these claims quickly without requests for additional information. Providers who maintain a clean claim rate of 95% or higher experience fewer delays in reimbursement, as errors like mismatched codes or missing prior authorizations are eliminated upfront.

How Long Does Claims Processing Take?

Claims processing timelines depend on the payer. Medicare typically processes clean claims within 30 days, while Medicaid timelines vary by state, ranging from 30 to 45 days. Private insurers generally follow a 30–45 day window, though electronic claims (submitted via HIPAA-compliant systems) often resolve faster, averaging 14–21 days. Paper claims, by contrast, can take 30 days or longer due to manual handling.

Can I Submit Claims Without a Clearinghouse?

While submitting claims directly to payers is technically possible, using a clearinghouse is strongly advised. Clearinghouses automatically flag errors like invalid codes or missing patient identifiers, ensure compliance with HIPAA standards, and simplify submissions across multiple insurers. Skipping this step increases the risk of rejections and delays, as payer.

What Happens If My Claim Is Rejected?

A rejected claim is typically due to errors such as incorrect patient information, coding mismatches (e.g., a diagnosis code that doesn’t align with the procedure), or missing prior authorization. When this happens, the claim must be corrected and resubmitted. Providers should carefully review the insurer’s Explanation of Benefits (EOB) to identify the exact issue, resolve it, and resubmit promptly to avoid further payment delays.

Can I Negotiate a Denied Claim?

Yes. Suppose a claim is denied (rather than rejected). In that case, providers can appeal by submitting additional documentation, such as medical records or a letter of medical necessity, to justify the service. Insurers may conduct an internal review, and if the denial stands, providers or patients can request an external review under the Affordable Care Act (ACA). Patients also have the option to negotiate payment plans or discounted rates directly with the provider for uncovered charges.

Conclusion: Optimizing Medical Claims for Providers and Patients

Efficient medical claims processing is essential for ensuring timely reimbursements, reducing denials, and maintaining financial stability for healthcare providers.

Accuracy in coding, documentation, and compliance is critical to preventing claim rejections and delays. Leveraging AI-driven automation, clearinghouses, and claims management software can streamline workflows and improve efficiency.

Understanding insurance coverage, the Explanation of Benefits (EOB), and the appeals process empowers patients to navigate medical bills and contest denied claims effectively. Staying proactive by verifying coverage, tracking claims, and negotiating bills can help avoid unnecessary financial burdens.

Providers can optimize the medical claims process by adopting best practices, embracing technology, and ensuring transparency. Many practices achieve this by leveraging the benefits of outsourcing medical billing services, including reduced denials, lower operational costs, and access to specialized expertise, leading to faster payments and improved revenue cycles.

Related Posts