The PC Ratio (Provider Contractual Ratio) is a key financial metric in medical billing that measures payments received against contractual obligations. It helps healthcare providers assess revenue cycle efficiency, optimize payer contracts, and reduce claim denials.

Table of Contents

What Is the PC Ratio in Medical Billing?

PC (Provider Contractual) Ratio

The PC Ratio represents the percentage of contractual revenue collected by a provider. It compares actual payments to the expected reimbursement from payer contracts..

- Formula: (Payments Received / Contractual Obligations) × 100

- Purpose: Measures how effectively a practice collects revenue from insurers.

How It Differs from Gross and Net Collection Rates

The PC Ratio differs from gross and net collection rates because it only considers contractual adjustments and payments, not total charges or net collections.

Gross Collection Rate vs. Net Collection Rate vs. PC Ratio

| Metric | Formula | Purpose |

|---|---|---|

| Gross Collection Rate (GCR) | (Total Payments / Total Charges) × 100 | Measures overall revenue collection efficiency. |

| Net Collection Rate (NCR) | (Payments / (Charges – Adjustments)) × 100 | Evaluates collections after contractual adjustments. |

| PC Ratio | (Payments / Contractual Obligations) × 100 | Assesses compliance with payer agreements. |

Why the PC Ratio is Crucial for Healthcare Revenue Cycle Management

The PC Ratio plays a key role in medical claims processing and revenue cycle management by:

- Identifying payer reimbursement trends.

- Detecting revenue loss from claim denials.

- Ensuring compliance with insurance contracts.

How to Calculate the PC Ratio: Formulas & Examples

Step-by-Step Calculation Formula

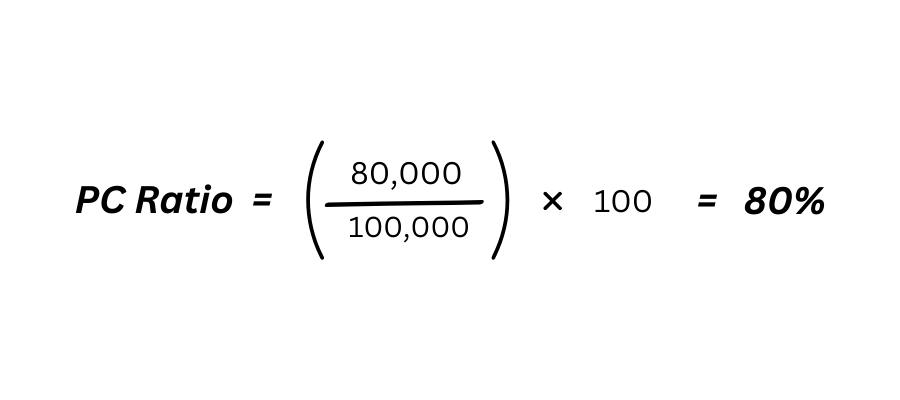

The PC Ratio formula is:

Real-World Example with Hypothetical Data

A clinic receives $80,000 in payments from insurance while contractual obligations total $100,000.

An 80% PC Ratio suggests underperformance in collections, requiring contract review or billing adjustments.

Common Mistakes to Avoid in Calculation

- Counting patient responsibility instead of insurer payments.

- Using total charges instead of contractual obligations.

- Overlooking claim write-offs and adjustments in medical claim processing.

Why the PC Ratio Matters in Medical Billing

1. Financial Impact on Healthcare Providers

A low PC Ratio signals revenue loss due to payer underpayments, denied claims, or contractual mismanagement.

2. Link Between PC Ratio and Practice Profitability

Higher PC Ratios improve cash flow, allowing better investment in staffing, technology, and patient care.

3.Operational Benefits: Reducing Denials and Delays

A high PC Ratio reduces:

- Claim denials due to coding errors.

- Verification issues cause payment delays.

4. How PC Ratio Reflects Billing Efficiency and Compliance

Monitoring the PC Ratio ensures:

- Accurate claim coding and contract adherence.

- Timely claim submissions and follow-ups.

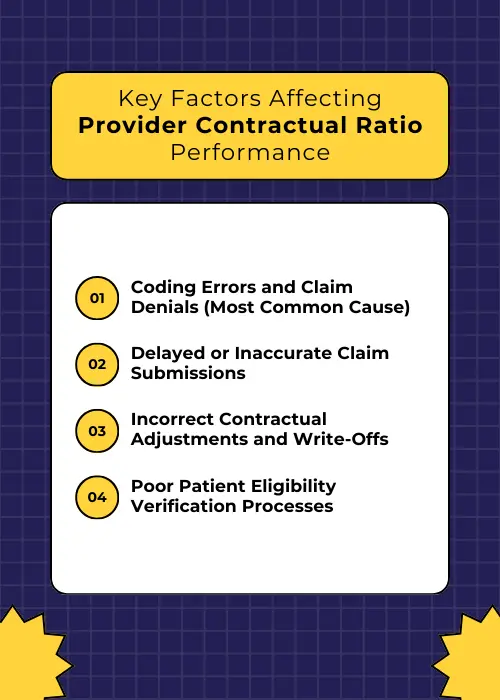

Key Factors Affecting Provider Contractual Ratio Performance

Coding Errors and Claim Denials (Most Common Cause)

- Incorrect CPT/ICD-10 codes lead to rejections.

- Upcoding/down coding affects reimbursements.

Delayed or Inaccurate Claim Submissions

- Missed deadlines lead to claim denials.

- Incomplete documentation slows processing.

Incorrect Contractual Adjustments and Write-Offs

- Improper adjustments reduce collectible revenue.

- Failure to appeal underpaid claims lowers the PC Ratio.

- Mismatched rendering and billing provider details cause underpayments.

Poor Patient Eligibility Verification Processes

- Unverified insurance coverage results in denials.

- Incorrect copay/deductible calculations delay payments.

7 Proven Strategies to Improve Your Provider Contractual Ratio

Optimizing the PC Ratio requires a combination of efficient billing practices, technology, and contract management. Implementing these seven strategies will help maximize revenue collection and minimize claim denials.

1. Audit Billing Processes Regularly

Regular audits help identify errors, underpayments, and inefficiencies in the revenue cycle. Key areas to review include:

- Claim denials and rejections to spot patterns.

- Incorrect contractual adjustments that lower collections.

- Underpaid claims that need appeals or renegotiation.

Tools for Auditing: EHR Systems, RCM Software

| Software | Functionality |

|---|---|

| Waystar | Tracks claim denials, underpayments, and payer trends. |

| AthenaHealth | Provides automated billing reports and financial insights. |

| NextGen RCM | Identifies revenue cycle inefficiencies and coding errors. |

| eClinicalWorks | Helps monitor claim status and contract compliance. |

2. Streamline Front-End Processes (Eligibility Checks, Pre-Authorization)

Front-end inefficiencies lead to claim denials and delayed reimbursements. Improving these processes enhances collection rates.

Key improvements include:

- Automated insurance verification at the time of scheduling.

- Pre-authorization tracking for procedures requiring insurer approval.

- Clear patient financial responsibility policies to reduce unpaid balances.

Benefits:

- Reduces claim denials due to eligibility issues.

- Increases point-of-service collections and upfront payments.

3. Train Staff on Coding Best Practices (e.g., ICD-10, CPT Updates)

Coding errors are a leading cause of claim denials, affecting the PC Ratio. Keeping medical billing staff updated ensures compliance and maximized reimbursements.

Key Training Areas:

- ICD-10 updates to prevent claim rejections.

- CPT and HCPCS coding accuracy for correct reimbursement rates.

- Modifier usage to avoid underpayments or claim bundling.

- Documentation improvement to justify billed procedures.

Training Methods:

- Monthly webinars and coding workshops.

- Access to AHIMA, AAPC, and CMS updates.

- Regular internal audits and feedback sessions.

- Ensure staff verify NPI details during claim submissions.

4. Leverage Technology for Real-Time Analytics

Real-time analytics allows healthcare providers to track PC Ratio fluctuations and take corrective actions quickly.

How Analytics Improve Provider Contractual Ratio:

- Automated alerts for claim underpayments and denials.

- Trend analysis to detect recurring billing issues.

- Payer performance monitoring to renegotiate reimbursement rates.

Top Software for Tracking PC Ratio: Waystar, AthenaHealth

| Software | Key Features |

|---|---|

| Waystar | AI-driven denial prevention, real-time revenue tracking. |

| AthenaHealth | PC Ratio monitoring, payer benchmarking, claims automation. |

| CureMD | Integrated billing reports, denial tracking, contract compliance. |

| Kareo | Small practice billing insights, A/R and claims monitoring. |

5. Negotiate Better Payer Contracts

Payer contracts directly impact the PC Ratio, making negotiation essential for higher reimbursement rates.

Steps to Improve Payer Contract Terms:

- Analyze payment data to identify low-paying insurers.

- Benchmark reimbursement rates against industry standards.

- Negotiate for reduced claim adjudication times to accelerate payments.

- Appeal underpayments and request contract adjustments if needed.

Key Metrics for Negotiation:

- Provider Contractual Ratio trends to highlight payer performance.

- Denial rates to pinpoint systemic issues.

- Average days in A/R to track payment speed.

6. Monitor KPIs: Days in A/R, Denial Rate, NCR

Tracking key performance indicators (KPIs) helps uncover revenue cycle inefficiencies that impact the PC Ratio.

Critical Billing KPIs to Monitor:

| KPI | Ideal Benchmark | Why It Matters |

|---|---|---|

| Days in A/R | < 40 days | Longer A/R cycles indicate slow collections. |

| Denial Rate | < 5% | High denial rates signal coding or payer contract issues. |

| Net Collection Rate (NCR) | > 95% | Ensures practice collects expected revenue. |

Best Practices for KPI Monitoring:

- Review reports weekly to spot trends.

- Use automated alerts for high A/R balances.

- Compare performance by payer to negotiate better contracts.

7. Partner with a Medical Billing Specialist

Outsourcing medical billing to experts ensures efficient revenue cycle management, leading to higher PC Ratios.

Benefits of Outsourced Medical Billing:

- Faster claim submissions with reduced errors.

- Denial management expertise for higher collection rates.

- Advanced analytics to improve financial performance.

Top Medical Billing Companies:

| Company | Specialization |

|---|---|

| Medibill RCM LLC | Based in Houston, TX, provides expert medical billing, coding, and credentialing services, helping healthcare providers optimize reimbursements and streamline revenue cycle management. |

| R1 RCM | Large hospitals, multi-specialty practices. |

| BillingParadise | AI-driven billing automation, denial management. |

| CureMD RCM | Small to mid-sized clinics, comprehensive claim tracking. |

| MedBillingExperts | End-to-end revenue cycle management. |

Implementing these seven strategies ensures a higher PC Ratio, leading to better cash flow, fewer denials, and stronger financial health for healthcare providers.

Reduce denials and improve cash flow with our Expert Medical Billing Services. We help practices increase collections while reducing administrative burdens – all for just 3.99%.

[Schedule a consultation today] to optimize your PC Ratio and unlock revenue growth.”

Case Studies: How Clinics Improved Revenue with PC Ratio Optimization

These real-world case studies highlight how healthcare providers improved their PC Ratio, reduced claim denials, and increased revenue through strategic billing optimizations.

Radiology Practice: Reduced Denials by 30% in 6 Months

A mid-sized radiology clinic struggled with high denial rates due to coding errors and eligibility verification issues. By implementing automated insurance verification, real-time claim tracking, and coder training on CPT updates. The practice reduced denials by 30% within six months, leading to a 15% increase in net collections.

Multi-Specialty Clinic: Increased Provider Contractual Ratio from 85% to 95%

A multi-specialty group faced challenges with incorrect contractual adjustments and delayed claim submissions, keeping their PC Ratio at 85%. After conducting monthly billing audits, renegotiating payer contracts, and leveraging AI-driven RCM software, the clinic increased its PC Ratio to 95%, resulting in faster reimbursements and improved cash flow.

Pathology Lab: Streamlined Adjustments and Saved $200k Annually

A pathology laboratory is frequently underbilled due to incorrect write-offs and misclassified contractual obligations. The lab corrected billing errors by implementing billing automation tools, staff training, and a stricter write-off review process. It saved $200,000 annually, significantly enhancing profitability.

These case studies demonstrate that strategic billing optimizations lead to higher Provider Contractual Ratio, lower denials, and increased revenue for healthcare providers.

Like these clinics, you can achieve a 95%+ PC Ratio and reduce denials by 30%. Let our team handle your billing complexities for only 3.99% so you can focus on patient care.

[Book a free consultation] to get started.

Advanced Tips for Long-Term PC Ratio Success

Maintaining a high Provider Contractual Ratio requires continuous improvement in billing efficiency, revenue cycle management, and financial monitoring. These advanced strategies help healthcare providers achieve long-term success.

Predictive Analytics for Denial Prevention

Using AI-driven predictive analytics, healthcare providers can identify patterns in claim denials and prevent issues before submission. Key benefits include:

- Automated error detection in coding and billing.

- Trend analysis to pinpoint common denial causes.

- Proactive claim corrections to improve approval rates.

Example: A clinic using AI-based denial prevention reduced denial rates by 25%, leading to faster reimbursements and an improved PC Ratio.

Automating Patient Payment Collections

Late or missed patient payments affect cash flow and net collections. Implementing automated payment solutions improves collection rates by:

- Sending digital invoices and payment reminders via SMS and email.

- Integrating online payment portals for easy transactions.

- Offering flexible payment plans to reduce outstanding balances.

Example: A multi-specialty practice using automated billing tools reduced patient A/R balances by 40% within six months.

Regular Benchmarking Against Industry Standards

Comparing PC Ratio performance to industry benchmarks ensures financial stability and competitive positioning. Key metrics to track:

| Metric | Industry Standard | Why It Matters |

|---|---|---|

| PC Ratio | >95% | Ensures optimal revenue collection. |

| Denial Rate | <5% | Indicates billing accuracy and payer efficiency. |

| Days in A/R | <40 days | Faster payments lead to better cash flow. |

Regular benchmarking helps identify revenue gaps and refine billing strategies to sustain a high PC Ratio.

FAQs About PC Ratio in Medical Billing

What’s the Ideal PC Ratio?

The ideal PC Ratio is 95% or higher, indicating that a practice collects nearly all contractually allowed revenue. A below-mentioned ratio suggests underpayments, billing inefficiencies, or high denial rates.

Can PC Ratio Be Higher Than 100%?

No, a PC Ratio over 100% is a red flag for billing errors, miscalculations, or incorrect contractual adjustments. This often signals overpayments, incorrect write-offs, or improper revenue recording, requiring an audit to identify discrepancies.

How Often Should PC Ratio Be Monitored?

PC Ratio should be monitored monthly or quarterly to track billing efficiency and revenue trends. Regular reviews help identify declining collections, payer issues, or coding errors, allowing proactive adjustments to maintain financial stability.